-

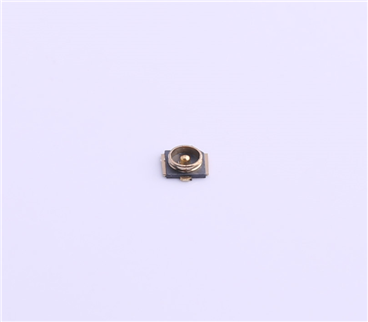

- RF Series

- Connector&plug-in unit

- Plug-in unit

- SD card holder

- SIM card holder

- Thimble /wire protector

- Crimping terminal

- Waterproof joint

- 短路帽/跳线帽

- 压线端子胶壳

- 屏蔽夹

- Waterproof and dustproof terminal

- Industrial&automotive&military

发布时间:2021-12-31作者来源:金航标浏览:2454

In terms of investment, industrial software is the most popular Xiaosheng at present, no less than chip. Capital pays close attention to it, which is a good thing, but it also brings a lot of overheated spotlights to this industry. The hot sweat of the striver flowed down, and the makeup powder of the performer began to slip.

The current valuation of industrial software is sky high. The normal market sales rate abroad is about 10 times, and now it is hundreds of times in China. What a frightening proportion. This is also the benefit brought by the first stock of tool software CAD - Guangzhou Zhongwang.

Zhongwang had a revenue of 400 million yuan last year and now has a market value of nearly 40 billion yuan. The market sales ratio is close to 100 times! This is a phenomenon that cannot be seen in the United States, the most mature software market.

PTC, a high-end CAD software company in the United States, has a market value of US $15 billion and a revenue of about US $1.4 billion. It looks like a premium of 10 times. However, it still relies on the theme that PTC has a strong industrial Internet and the concept of SaaS cloud CAD. Otherwise, it can not support this valuation.

The simulation is hotter. The market value of ANSYS, the world's largest simulation company, is US $32 billion, while the sales in 2020 is about US $1.6 billion. The premium is 20 times, which is almost the best reward given by the market to top students. To say that the veteran driver of ANSYS is an old driver, let's take a look at rookie Altair. The CAE company listed in 2017 has a revenue of $470 million in 2020 and a market value of $5.4 billion. More than 10 times the level. At present, international M & A is basically this line.

If capital finally makes China's industrial software lively, what's wrong? There are many benefits. I have called for six or seven years. It is also a happy thing that everyone pays so much attention to industrial software.

There are still many phenomena against common demons.

The first is to push up the mentality of software practitioners. Software mergers and acquisitions are becoming more and more difficult. Many software prices start from scratch, making it difficult for even people with large amounts of money to acquire enterprises.

Chinese industrial software is not available for acquisition of foreign software; The acquisition of domestic software is not worth it. This seems to block the most common way of M & A for software growth.

The second is a bigger problem, fairness. Ambitious large enterprises suddenly feel that software is a capital soft egg that can be pinched. So many large enterprises began to develop their own industrial software - the earliest time for industrial software giants to make software was the spring and Autumn period and the Warring States period, which has passed forever. It is difficult for large enterprises to be effective in making software, except for the financial allocation that takes all their efforts.

The third is the emergence of an unexpected internal volume market. With money, there are more competitors in the low-end market. The Red Sea is even more red. Even the pioneers who have been out of the siege and gradually growing in the low-end market are once again trapped in encirclement and suppression. In the high-end market, due to the high threshold, there is only a limited influx of funds.

Faltering in tackling tough problems and invincible in attacking weak ones. This is also a new scourge brought about by capital. However, the software industry is still rolling forward. These disadvantages are all by-products. Unfortunately, the efficiency could have been higher.

Industrial software is really a wonderful market. No money to hell, money to see the demon#Industrial software#

Copyright © Shenzhen Kinghelm Electronics Co., Ltd. all rights reservedYue ICP Bei No. 17113853