-

- RF Series

- Connector&plug-in unit

- Plug-in unit

- SD card holder

- SIM card holder

- Thimble /wire protector

- Crimping terminal

- Waterproof joint

- 短路帽/跳线帽

- 压线端子胶壳

- 屏蔽夹

- Waterproof and dustproof terminal

- Industrial&automotive&military

发布时间:2021-12-31作者来源:金航标浏览:2858

Reading Guide:I always thought I was a civil servant, but in the end I was a contract worker. If you don't want to be manipulated by fate, you need some temporary ideas to take fate by surprise.

1. You can control yourself, but you can't control your men

2. Who buys who

Around 2012, Wu muxing, chairman of Singapore Xinye group, visited lilda group. When the wine was in full swing, Wu muxing said: I think the cooperation between the two companies is congenial. Let's just become a family!

Chairman of lilda Chen Xianxing humorously replied:It's OK to fall in love and get married a little early!Skillfully and tactfully rejected the acquisition proposal of Xinye group.

In May 2018, Xinye group divested its Hong Kong and mainland businesses, established core holding group and planned to be listed in Hong Kong. In September 2018, Texas Instruments (hereinafter referred to as Ti), a leading analog chip enterprise, cancelled Xinye's agency right, and Xinye's performance loss exceeded60%, the listing plan ran aground.

In February 2019, the LDA group announced that it was a joint venture with Xinye (Hongkong), which is responsible for the sales of products such as semiconductor, passive devices and electronic connectors in Hongkong and Chinese mainland markets, and the possibility of exploring other potential businesses. Among them, lilda shares51%, held by Xinye49%。

History pays off those who have a heart. Time is the best answer to who buys who.

3. Ti's top disciple

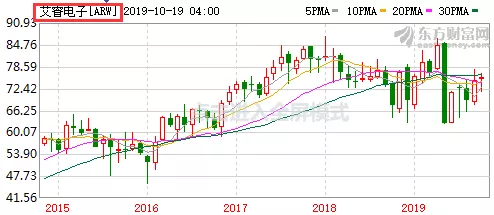

Figure: iResearch ElectronicsNearly fiveyearStock price trend

In the market, there are more rumors that the biggest reason Ti chose airy electronics is that they haveCommon shareholders and interests, is that really the case?

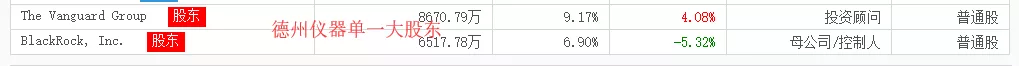

Figure: ti's largest single shareholder

Ti's largest single Shareholder:American pioneer group。

Pioneer group is the largest free fund family in the world and the second largest fund management company in the world. It now manages more than 370 billion US dollars of assets around the world.

BlackRock groupIt is the largest listed investment management group in the United States. Recently, it has reduced its holdings of Ti shares and retired to the second largest shareholder.This wave of operation more illustrates BlackRock group's struggle and wait-and-see attitude towards the uncertainty of the trade war, as well as its impact on TI's performance.

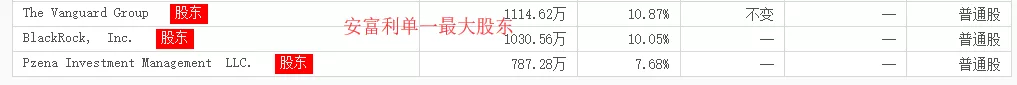

Figure: the largest single shareholder of iResearch Electronics

From the above figure,The largest single shareholder of iResearch electronics is also the American pioneer group。

Interestingly, pioneer group, the single major shareholder of Ti and airy electronics, recently chose to increase their shares,The proportion of shareholding increase was 4.08% for Ti and 1.41% for iResearch electronics。

Judging from the stock trend of the two companies, the profit space of this wave of operation is extremely amazing. Of course, as the cornerstone shareholder and Dinghai Shenzhen, high growth and stable long-term income are the most valued.

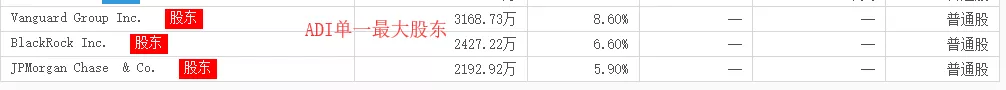

Figure: anfuli's largest single shareholder

However, from the perspective of anfuli's shareholder structure,vanguard groupIt is still its single largest shareholder, and BlackRock group is still the second largest shareholder. But the only difference between the two is that one is adding chips and the other is firm.

It seems that it is not the same thing to explain the strategic binding of the two sides from the perspective of shareholders. For listed companies, American funds have always been financial investment rather than strategic investment. It seems,Ti chose airy electronics for another reason。

5. Ti's direct selling strategy

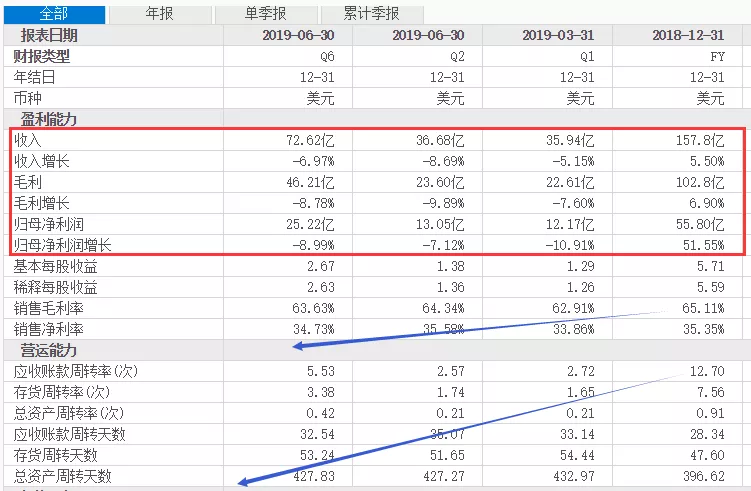

In 2018, Ti had sales of US $15.78 billion, gross profit margin of 65.11%, net profit margin of 35.35% and net profit of US $5.58 billion. Analog revenue is US $10.8 billion, and embedded products are about US $3.554 billion. In addition, the revenue in China accounted for 44% and that in Asia accounted for about 64.05% (including Japan).

In May 2019, Dave Pahl, vice president of investor relations of Ti, said in a conference call with JPMorgan,Ti has four competitive advantages, the most extensive and distinctive analog and embedded processing product series, the most extensive market channels, the diversity and long-term nature of products, markets and customers, and a solid technical and manufacturing foundation.

In TI's huge 100000 product library, about 300 to 400 new products are added every year, and the company has a total of about 65 to 70 product lines. Ti store's website can solve customer design problems faster and attract more customers because of its wide range of products. No matter what they are looking for, Ti can provide them with something.

Then when Ti interacts with website customers, the company has the opportunity to cross sell more products.

He said that one of TI's four competitive advantages isAccess channel, we have let the team go out and try to find ways to strengthen our relationship with customers more directly and closely. The other isOwn and control inventory in the channel, about two-thirds of TI's revenue is now supported by consignment. When Ti completes the next phase, the company may be close to70%The proceeds are used for consignment.

During the period of weak demand, we built small quantities of parts that we considered to be long-lived, and we did so to make our delivery time and product availability very high. Ti is doing this to ensure that they have very good customer service. This batch of parts may be completed before the end of this year.

——Ti investor relationsDave Pahl, vice president

In other words, in order to direct sales strategy and direct customers, Ti has been in the market for a long timeContinuously prepare consignment inventory and long-life small batch parts for Ti store websiteAt the same timeA huge ground sales force took over the agency business。

Plan ahead and be the first to eat crabs, which is the greatest strength and courage of TI's direct sales strategy.

Due to the uncertainty of trade disputes, Huawei's revenue accounts for about 4% of TI's revenue, which makes investors struggle.

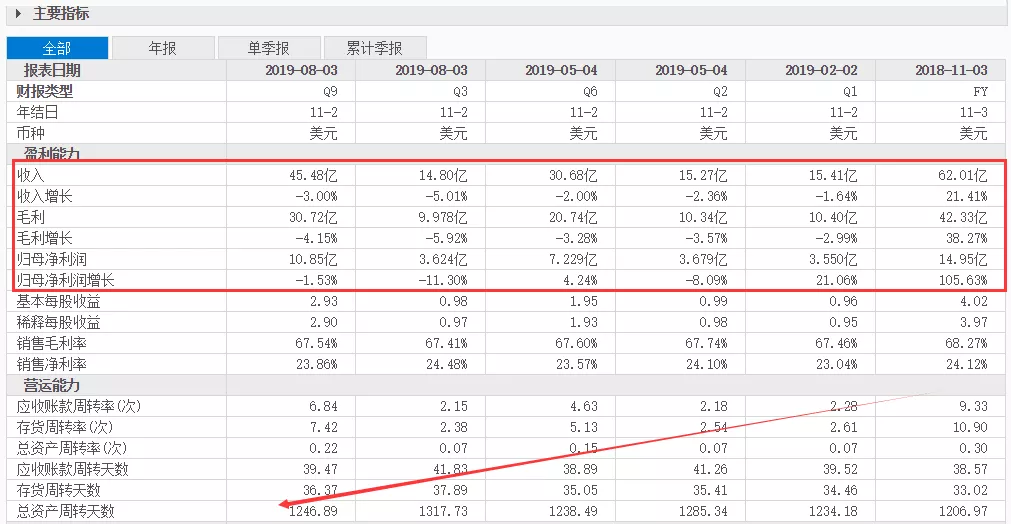

From the latest semi annual report in the figure below, Ti vigorously implements consignment inventory, which will alsoBring pressure to inventory financial cost。 Moreover, about two-thirds of TI's revenue is supported by consignment, and the inventory turnover days and capital turnover rate are facing certain challenges.

Figure: Ti core financial indicators

From the above figure, TI's financial indicators are under great pressure. However, judging from the stock price trend of Ti, investors have reaped a lot of returns in recent years; With the bearish clouds of the trade war and the advent of the peak season in the second half of the year, the performance is expected to stop falling and pick up.

Figure: ti's stock price trend in recent five years

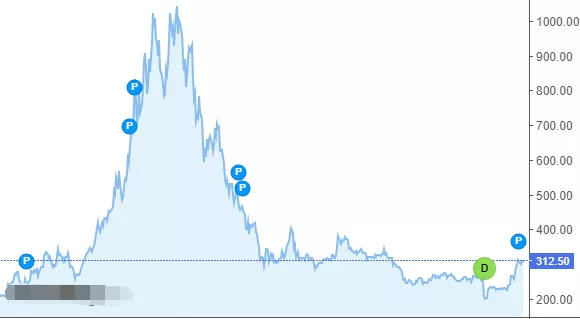

Let's take a look at the stock price and performance trend of ADI, TI's largest competitor. In recent years, the stock price has risen from $40 to more than $100Analog chip winner after Ti。

Figure: ADI stock price trend in recent five years

In terms of financial indicators, ADI is also showing a downward trend this year, which has also affected revenue, inventory and turnover, gross profit margin and net profit margin. Compared with Ti, ADI's indicators are slightly better, which may be related to ADI's preference for industrial and military markets.

Figure: ADICore financial indicators

At the shareholder level,ADI's shareholders are strikingly similar to Ti。 Are familiar faces, are familiar recipes. The only difference is that BlackRock group has reduced its holdings of Ti and maintained a fixed strategy for ADI.

Figure: ADI's largest single shareholder

In fact, a long time ago, ADI and Ti confirmed their eyes and started quietlyDirect sales and online sample sales, it's just that it's low-key and doesn't start on a large scale. The agents are suffering from no solution and can only pretend that they can't see or hear.

Figure: sample direct selling service on ADI official website

Distributors, it's time to make a big change. Are your thighs thicker than anfuli and the General Assembly?It's said that domestic chips are recruiting. Hurry to report!

If you want to wait until the flowers are red, you may only have foot washing water left.

Open your palms. Why is the lifeline of agents getting shorter and shorter?

It is said that in October 2019, the former PM Senior Director of ansenmey semiconductor (referred to as on) and the person in charge of the on product line of an agent "defected" to the competitor.

The original factory is far away and the customers are close, but you are "digging at the foot of the wall". No wonder Ti doesn't like it.

The stock price trend of a passive component company was almost blown up by 600 tons of MLCC deep-water explosives. It was unimaginable and unimaginable.Fortunately, the bosses worked together and succeeded in freezing;In the second half of the year, the harvest of passive components is a foregone conclusion. It depends on who can get rid of the clouds and see the sun first.

Figure: stock price trend of a passive device manufacturer

Copyright © Shenzhen Kinghelm Electronics Co., Ltd. all rights reservedYue ICP Bei No. 17113853