-

- RF Series

- Connector&plug-in unit

- Plug-in unit

- SD card holder

- SIM card holder

- Thimble /wire protector

- Crimping terminal

- Waterproof joint

- 短路帽/跳线帽

- 压线端子胶壳

- 屏蔽夹

- Waterproof and dustproof terminal

- Industrial&automotive&military

发布时间:2021-12-31作者来源:金航标浏览:3951

Reading Guide:On May 23, 2020,Tailong lighting(GEM, securities code: 300650) announced that it plans to acquire 100% equity of quanxinke, upkeen global and fast achievement by paying cash. The main assets held by the subject matter of this transaction areBosida Technology (Hong Kong) Co., LtdandXinxing Electronics (Hong Kong) Co., Ltd100% equity of.

Mr. Yuan Yi, an evergreen of semiconductor distribution, once again stood in the spotlight in this way and became the focus of the industry. In fact, judging from his past resume, maybe he was born to be so dazzling.

Runxin TechnologyProvocation of

On January 11, 2018,Runxin Technology(GEM, securities code: 300493) announced that its wholly-owned subsidiary, Runxin qinzeng, plans to acquire upkeen global49 in cash 00% equity and fast achieve49 00% equity. The transaction amount was HK $175 million (about RMB 146 million), accounting for 24.99% of the total target.

On July 26, 2019, Runxin technology held the eighth meeting of the third board of directors, considered and approved the proposal on suspending the planning of major asset restructuring, and agreed to suspend the planning of this major asset restructuring.

With the introduction of the acquisition plan of Tailong lighting, Runxin technology gives people roses with lingering fragrance, which is also a gentleman's style.

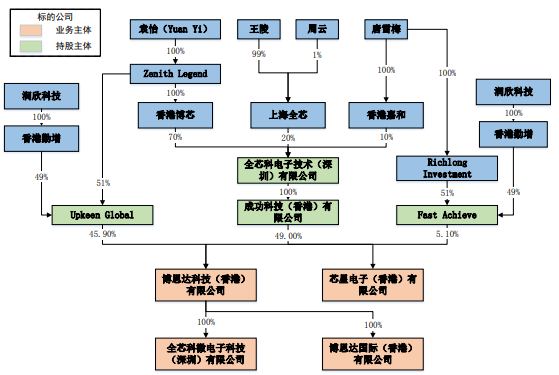

Equity structure of transaction object

Specific content of transaction scheme

1. Telong lighting is transferred from the shares jointly held by Hong Kong Boxin, Shanghai Quanxin and Hong Kong Jiahe100% equity of whole core technology。

2. Telong lighting transferred the shares held by zenith legend and Hong Kong qinzeng100% equity of upkeen Global;

3. Telong lighting is transferred from the shares jointly held by richlong investment and Hong Kong qinzengFast achievement 100% equity;

The above overall acquisition contents can not be separated separately and jointly constitute the transaction of Tailong lighting. After the completion of the overall acquisition, Tailong lighting will hold 100% equity of all core technology, 100% equity of upkeen global and 100% equity of fast achievement. Combined with direct and indirect shareholding, bostar and Xinxing Electronics will become a wholly-owned subsidiary of Tailong lighting after the completion of the overall acquisition.

Transaction pricing

The valuation of the underlying assets adopts the income method and asset-based method. The main business of the underlying company occurs in bostar. Therefore, the underlying company is collectively referred to as bostar asset group. The basic pricing of this transaction is RMB750 million yuan, the actual equity transfer price shall be adjusted according to the date of delivery. In this transaction, except that the transaction price of Hong Kong qinzeng (the parent company is Runxin Technology) is Hong Kong dollars, the transaction price of other counterparties is RMB.

As the transaction plan can only be reached through the overall acquisition, Hong Kong qinzeng still needs to obtain the approval of the general meeting of shareholders of its parent company Shanghai Runxin Technology Co., Ltd. to sell its 49% equity of upkeen global and fast achievement.

Performance commitment period and amount

The commitment period of the profit commitment involved in this transaction is 2020, 2021 and 2022. The indemnifier promises that the consolidated net profit of all target companies after deducting non recurring profits and losses in 2020, 2021 and 2022 shall not be less thanHK $65 million, HK $78 million and HK $92 million(all inclusive). Hong Kong qinzeng (Runxin Technology) does not participate in performance commitment.

On May 22, 2020, Tailong Lighting Co., Ltd. and Shenzhen Songhe Growth Fund Management Co., Ltd. signed the non-public development bank stock subscription agreement with conditional effect. Shenzhen Songhe Growth Fund Management Co., Ltd. will subscribe for the non-public shares of the listed company with the managed fund, and Yuan Yi will subscribe for the fund. After the completion of the non-public offering, Yuan Yi will indirectly hold more than 5% of the shares of the listed company.

Hidden bosda

In 2018 and 2019, bostar achieved operating revenue respectivelyRMB 1819791800

2009.025 million yuan, net profit is52.4415 million yuan, 63.3876 million yuan。

Bostar's main business is semiconductor distribution related to wireless communication and consumer electronics, mainly RF front-end chips of mobile phones. In addition, bostar's products also include CMOS camera sensors, MEMS speakers, video image processing chips, geomagnetic meters, gyroscopes, accelerometers, optical distance sensors and other products.

In terms of upstream original factory cooperation, bostar has cooperated withQorvo、AKM、InvenSense、Sensortek、Dialog And other world-famous electronic component manufacturers, and its main products cover emerging downstream application fields such as smart phones, TWS headphones, smart speakers and robots.

In terms of customer cooperation, bostar has obvious advantages in the field of mobile phone RF chips. Its customers are mainly mobile phone brand enterprises and large mobile phone}odm enterprises, such asXiaomi, oppo, Huaqin communication and Wentai TechnologyWait.

Evergreen Yuan Yi

Mr. Yuan Yi, yesOne of the witnesses and pioneers in the semiconductor field between China and the United States。 With his efforts, Texas Instruments entered China. From 1995 to 2000, he served as the chief representative of Texas Instruments in China; From 2000 to 2005, he was the general manager of Broadcom China.

From 2005 to 2008, Mr. Yuan Yi served as president of TCL Communication Technology Holdings Co., Ltd; During this period, he suggested that TCL enter the field of mobile phone ODM. At that time, TCL faced many choices and finally used Alcatel to win a strategic victory in the international market. From 2008 to 2015, Yuan Yi served as president of Ketong group (00400. HK), signed many large European and American semiconductor lines, and promoted Ketong to Qingtian.

In 2015, Yuan Yi decided to leave Ketong from the peak and make bostar famous all over the world and become a world leaderQorvo is the largest agent in China and has become an important supply chain partner of Xiaomi。 Mr. Yuan Yi is currently the president of bostar.

Tailong lighting

Since its listing, Tailong lighting has focused on the field of commercial lighting. The company's main business is to provide overall solutions for commercial lighting integrating lighting design, development and manufacturing and system comprehensive services. Its main products include lighting appliances, LED displays and photoelectric signs. Operating revenue in 2017, 2018 and 2019 respectivelyRMB 338 million, RMB 487 million and RMB 560 million,Healthy development of main business. At the same time, the company actively expands markets in other segments to find new performance growth points for the company.

Xintailong lighting

Strictly speaking, the current market value management of Tailong lighting is poor. As of May 22, the total market value is onlyRMB 1.771 billion。 The arrival of bosida and Yuan Yi can be said to be enjoyable and at the right time. Mr. Yuan Yi and his bosida professional team will probably raise Tailong lighting to a new height in the electronics industry.

After this acquisition, Mr. Yuan Yi's experience will help to accelerate the improvement and optimization of the modern enterprise management mode of Tailong lighting. Mr. Yuan Yi has rich experience and resources in the semiconductor industry and can help the strategic transformation of listed companies. The listed company hopes to enter the field of semiconductor distribution through M & A of bostar, and gradually cut into the design of semiconductor application scheme relying on bostar's professional technical team.

After the completion of this transaction, the listed company will realizeParallel development of "commercial lighting semiconductor distribution", further enrich and expand business scope,wholeImprove the asset scale, profitability and comprehensive strength of listed companies to achieve a win-win situation for all shareholders of Tailong lighting.

Copyright © Shenzhen Kinghelm Electronics Co., Ltd. all rights reservedYue ICP Bei No. 17113853