-

- RF Series

- Connector&plug-in unit

- Plug-in unit

- SD card holder

- SIM card holder

- Thimble /wire protector

- Crimping terminal

- Waterproof joint

- 短路帽/跳线帽

- 压线端子胶壳

- 屏蔽夹

- Waterproof and dustproof terminal

- Industrial&automotive&military

发布时间:2021-12-31作者来源:金航标浏览:2252

This intelligent particle is called MEMS sensor.It is half a chip and half a machine. It is like a micro mecha warrior armed with a full chip, which has changed profoundlyThe interaction between man and nature.What makes it refreshing is that it is the first sensor beyond human senses. This mystery is hidden in smart phones. As early as the iPhone 5 in 2012, four MEMS sensors were used. The real wireless headset TWS, which has become more and more popular in the past five years, is behind the contribution of MEMS.

The Jianghu of suppliers in this field is basically calm. Thirty enterprises can account for 90% of the overall sales. They are basically the old faces on the list, half mechanical and half chip, competing on the track.

Boring Jianghu, refuse surprises

The global MEMS revenue will reach a market of more than 100 billion yuan in 2020. There are still many old faces in the Jianghu. But HP, the king ten years ago, has run from the first to the back, and Broadcom has sprung up. One sink and one float, behind which is the desktop computer era, turning to the mobile Internet in an all-round way. Printer sales fell, while the MEMS sensors required for printer inkjet continued to decline, while the market for RF sensors of smart phones expanded sharply, which made it difficult for suppliers such as Broadcom to make money.

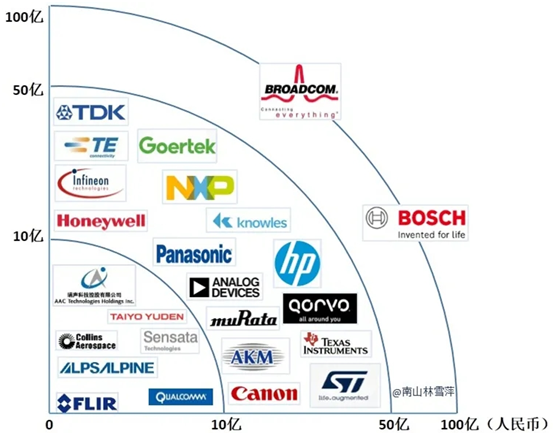

On the whole, this is a boring Jianghu. Not many surprises. The chip industry is pointing to great integration. However, MEMS sensor is an alternative. It refuses to choose the form of oligopoly, but maintains the situation of multiple competition. It probably presents the situation of two eldest brothers with more than 20 younger brothers. Broadcom and Bosch are two heroes, each leading the industry with an income of nearly 10 billion yuan; Followed by the intermediate players who cut half, about 5 billion yuan, down in turn. Like the keys of a piano, they are arranged continuously and evenly from the high range to the low range. With a revenue of 500 million yuan, it can almost enter the global top 30 list.

Figure 1 sales distribution of MEMS top25 enterprises in 2019

(source: statista 2020, drawn by Nanshan Institute of Technology)

MEMS sensor pattern basically follows the footsteps of the semiconductor industry. The strongest is still the United States, accounting for more than half of the country. Europe occupies a place with major manufacturers such as Bosch, Italy, France and NXP, and Japan is unique with multiple brands. South Korea was unexpectedly absent, while China occupied two seats by the microphone of real wireless headphones.

The Jianghu is full of unique heroes

In the global MEMS sensors, Botong and Bosch are the two dominant reasons.

However, the reasons for their leading are different.

With a revenue of $1.5 billion, Bosch has been almost at the top of the list for many years. The most powerful thing about it is that it can step on multiple ships in the application market. Its performance in the consumer and automotive markets is too strong. Each new car contains an average of 5 Bosch MEMS, while half of the world's smartphones contain at least 1 Bosch MEMS. Different from the diversification strategy of other manufacturers, Bosch only provides MEMS sensors rather than products in this field (for example, although Ruisheng has a revenue of 17 billion yuan in 2020, most of it is contributed by headphones rather than sensors). This also makes Bosch's success in MEMS business particularly dazzling.

The trouble with Bosch MEMS sensors is that there are a lot of harassers, like lions stared at by a group of small mustache dogs. Ruyi method semiconductor directly competes with the same type of equipment in the consumer market, but it is not active in the automobile market; NXP has competitive sensors, but it can only drive in the automotive field. Bosch occupies the fields of consumer electronics and automobile at the same time, and no one has such strength.

Broadcom was originally an outsider. Although it is a chip giant, it has no place on the list before 2016. In 2016, a MEMS RF sensor acquired Broadcom and continued to name the new company Broadcom (it should be accurately called new Broadcom). As a result, the runner up position in 2016 became Broadcom, and the second year became the world's largest MEMS manufacturer. This amazing market driving force comes from smart phones. 4G mobile phones began to popularize the mobile Internet, which greatly increased the demand for such sensors. Smart phones have rewritten the industrial pattern of MEMS. Italian French semiconductor st and Texas Ti, which used to be the top 3 manufacturers, were roughly pushed behind by smartphones.

Broadcom's troubles are lonely and sharp. Because it is being chased by a cheetah with stronger acceleration. This cheetah is American qorvo. In the RF MEMS field, both companies are strong in the same equipment type. Among the top 30 MEMS companies in the world in 2016, qorvo has begun to show amazing acceleration.

The king has no glory

Ten years ago, Ti and HP took the top spot.

In the past decade, the most helpless should belong to Ti. Its MEMS product revenue has been maintained at the level of $800 million. As the original products have been saturated, the sales growth is weak, and Ti has to wait for the maturity of the new market. However, applications such as 3D gesture recognition, automotive head up helmet HUD or intelligent lighting have not formed an obvious start to TI's products. These are the embarrassments of Ti. Its turnaround depends on the lidar in the vehicle market.

HP is the twilight hero in the boundless night. When it split the measurement part from the computer department and sold it, it was obviously a misjudgment for the future. This sold Department eventually evolved into the global leader of MEMS sensors, Broadcom.

When HP sold, it seemed that it sold its soul. HP executives thought there was only one track, and personal computers and printers were the king. Ti of Texas Instruments at that time also showed an aging pace. Its digital processor failed to catch the fast ship of LCD flat-panel TV. The first place is the competition between two elderly people, but the times have turned over. The number of home printers is getting smaller and smaller. Instead of printing a lot of documents, people began to use smartphones and tablets. During this period, Jinshan WPS software did not gain a firm foothold in the desktop market, but it showed its skills on the mobile reading page. The reason why WPS can rise curvilinearly is HP's falling killer. If printer sales decline, the demand for inkjet heads will be affected. Similarly, the sensor business of Canon and Epson in Japan is also dragged down by the decline of printers, which means that they feel pity for each other. Under the big waves, it is often not one company that sinks, but all the competitors in the past.

The rest is scuffle

STMicroelectronics ST's MEMS business has a glorious history. The "anti collision data protection" notebook launched in Toshiba was amazing. When the notebook is in the falling state, MEMS will automatically sense and start, and turn off the data hard disk, so as to effectively protect the data. This is a scene developed by st for Toshiba and subsequent IBM notebooks (the story is described in the book gray innovation as "long arm gray innovation"). Now, although it has been difficult to gain in the automotive and industrial MEMS markets, it still has a strong background, and apple is its most important customer. As the only major customer, it has been on alert.

Qorvo is currently ranked fifth. In Huawei's high-end mobile phones, this company is an indispensable chip list. As an RF manufacturer, it is really a newborn calf. It has made rapid progress in recent years. Qorvo was formed by the merger of two RF solution suppliers in 2015. It also has a strong national defense and military industry background. Subsequently, it caught up with the great development of RF sensors. Since its establishment, qorvo has made many mergers and acquisitions to expand its product line. Qorvo's fierce offensive is destined to bring a lot of trouble to champions like Broadcom.

The rest is a fraternal scuffle. Infineon, Sensata, Sensata, Denso, Amphenol and melexis focus on the automotive market. Alps, AKM, Sony and Murata mainly serve the consumer market. Panasonic focuses on the industrial field, and Honeywell focuses on the industrial and aerospace military industry. Tyco te NXP NXP has been involved in many markets. Due to multiple acquisitions, Tyco's diversification ability has been greatly enhanced.

The biggest change in the MEMS market over the past 10 years has come from smart phones and related products such as smart headphones. In addition, there is no device that can really change the market situation of MEMS. Surprisingly, although automotive electronics rose, it did not add a new face to this market. Augmented reality AR and other thunder and rain are small, which makes people have to be disappointed.

Boring stock market

TDK, a Japanese electrochemical company, has always been a pioneer in electronic raw materials and components. As the former king of tape recorders, tapes and computer disks, it now focuses on various capacitors and sensor systems. It has many different brands.

Around 2015, TDK ate three companies in a row with its suddenly realized belief and determination to catch fire in the old house. It has become the number one among nearly ten MEMS manufacturers in Japan, pressing Panasonic, electric equipment and Asahi Kasei. It is noteworthy that the two companies acquired by TDK are the third and fourth listed MEMS companies in the world.

Meixin, another listed MEMS company, was founded by Chinese. After becoming the first listed company in the United States in 2009, it had a bright future, but it became a capital victim. In 2012, due to continuous losses, it was privatized by IDG capital. Subsequently, IDG began to prove that it was the legendary hot hand, and the main business of MEMS was diluted. After a series of rescue, drum passing, flower passing and drum passing, Meixin has been divided into three companies. There is only one goal, that is, we can't wait to be listed. The final destination of this effort is the science and innovation board. The capital of eager for quick success and instant benefit has added a lot of small forks to the original excellent resume of good students. Rivers and mountains seem to have, and the face is no longer.

It can be said that the stock market did not bring good news to these MEMS companies. None of the four MEMS listed companies has been successful in the past 20 years. This fully shows the cruelty of the MEMS market. Brands that only rely on MEMS business (whether sensors or OEM) basically do not have the ability to survive independently, and the stock market cannot be saved.

A new Chinese tune

The sensor is a super short board made in China. It is regrettable that this market has not been paid enough attention. However, among all sensor categories, MEMS sensor is outstanding in development. It seizes the opportunity of smartphone microphone.

MEMS microphone is the most dazzling star in the past two decades. In 2002, Loushi electronics mass produced the first MEMS microphone, followed by Ruisheng and goer in China, and other opportunities were left to Infineon, TDK, NJRC, etc.

Chinese manufacturers have made remarkable breakthroughs in the MEMS field, including microphones for smart phones and wearable devices, and have the potential to compete with Lou in the global market.

In 2013, Lou's income reached 3 billion yuan, and then it was like jumping into a magic circle of the monkey king. It never jumped out again until now. That is, in this year, Lou electronics launched an intellectual property investigation on Goethe, starting from the packaging patent; Goethe also fought back quickly. A year later, the two sides not only shook hands and made peace, but also concluded further business cooperation. The advantage of low-cost manufacturing in China has been proved to be a strong core competitiveness, which is beyond the reach of foreign enterprises.

Ruisheng and Goethe have proved the feasibility of catching up with the mature market model. In this real wireless TWS headset market of 150 billion, China's second wave challenger has begun to enter. There are Suzhou Minxin, which was just listed last year, with a revenue of 330 million in 2020, and Fujian xirenma, a cutting-edge force. The latter just launched a new MEMS microphone in May this year. As a sensor enterprise operating in the vertical manufacturing IDM mode in China, the company's innovation is worth looking forward to. General micro gemes, which has just completed financing, is also eager to try. Its high-end products will be entrusted to Sweden silex, the second largest MEMS OEM in the world, which is a rare acquisition in the sensor field in China.

The oracle of the future

It is not easy to figure out the future pattern of MEMS. As a component, it cannot make its own efforts, and can only rely on the development of intelligent products.

American te company holds its own destiny through M & A. As the world's largest sensor and connector company with an annual revenue of US $13 billion, it has a good performance in the fields of consumer goods, industry and medical treatment. In 2019, it acquired German firstsensor, which is the most important sensor for transformers in the chemical industry. Chongqing Chuanyi, the most important transmitter manufacturer in China, has been using this brand of sensors. Another transmitter manufacturer is Beijing Far East Rosemount, a company owned by Emerson of the United States. This means that the two largest transmitters in China rely on American sensors. The keys to the gate of life are in the pockets of Americans. This move has greatly stimulated Chinese instrument manufacturers.

Many emerging markets are waiting for MEMS sensors. For example, UAV, combined with satellite navigation, is a new exciting point. E-cigarettes are also an emerging market. The digital differential pressure MEMS sensor can realize the air flow detection of electronic switches. In this regard, Hefei Weina, goer, Suzhou Minxin and Shanghai Sirui have layout.

And MEMS clock field. The leader is sitime, with a market share of 90%. As an all silicon oscillator, it completely replaces the traditional quartz oscillator products with high performance and low cost. What do we need this timing for? The car has proved itself to be a four-wheel supercomputer. The diversity of electronic devices determines that there must be a consistent heartbeat system. A car needs up to 70 timing devices. The well-known timing devices such as GPS and reversing camera are actually insignificant scales. The time required for autopilot requires accurate 1/1000000000 seconds. Or think again, when Da Vinci scalpel is operated, more than 400 sensors need to have amazing consistency. These are the thrilling moments of MEMS clock. Sitime is looking for its own market space in these time scales that human beings can't touch.

New MEMS products are like the flowing water in the field. It is constantly looking for the direction of minimum resistance. Since in the microphone field, many companies, such as TDK and Infineon, have continuously released new digital MEMS microphones suitable for such voice applications. The next breakthrough is the speaker. In the past few years, several companies have developed MEMS based micro speakers and are trying to change this ancient technology. Maybe Bose, an old brand of speakers, should tremble. Will the speakers be overturned by these emerging technologies? The headphones have dried down anyway. Sennheiser's consumer business unit, the world's top audio giant and the first of the four traditional hifi brands, was sold in May. The purchase price is 1.6 billion yuan, but its revenue in 2020 is 2 billion yuan. It can be said that it was almost sold for money. It fell under the knife of full fidelity headset TWS.

Automotive electrification brings contradictory news to MEMS industry. The good news is that electrification and automatic driving have brought a bigger cake to MEMS. For HEV with internal combustion engine, the good news continues. After all, the engine needs to use multiple pressure sensors. But for pure electric vehicles, because there is no internal combustion engine, there is no demand for powertrain sensors. The automotive powertrain accounts for 51% of the total demand for MEMS pressure sensors. This means that leaders, such as Bosch, Infineon and Japan electric equipment, must brake and change lanes in advance.

Notes: intelligent prophecy

Even so, MEMS sensor is still a prophecy. Everything has eyes and revolutionizes the future. Every move of MEMS manufacturers is like a reference book on future products, indicating all possible intelligent roads.

Copyright © Shenzhen Kinghelm Electronics Co., Ltd. all rights reservedYue ICP Bei No. 17113853