-

- RF Series

- Connector&plug-in unit

- Plug-in unit

- SD card holder

- SIM card holder

- Thimble /wire protector

- Crimping terminal

- Waterproof joint

- 短路帽/跳线帽

- 压线端子胶壳

- 屏蔽夹

- Waterproof and dustproof terminal

- Industrial&automotive&military

发布时间:2021-12-31作者来源:金航标浏览:2287

I'll change my face first. You change with me

Whether it is industry 4.0, intelligent manufacturing and industrial Internet, it brings people a new industrial style. With the intervention of a large number of ICT manufacturers and Internet of things manufacturers, cutting-edge Corps such as artificial intelligence and big data analysis have been added, and the digital market of the whole industry is lively. This makes people feel that industry is being coerced by ICT. However, after three or four years, the leading force that really makes the digital transformation of factories and workshops is still automation manufacturers.

This is not surprising. In this market, they have always determined the operation principle of higher quality, higher efficiency, lower cost and shorter delivery time. From the beginning of the first programmable control PLC applied in the General Motors factory, the dominance of automation in the factory has never wavered in the past 50 years.

However, in the global $200 billion automation market, these manufacturers have long been beyond recognition. If the digital industry is the change that people most expect to happen, then the most dramatic start of this drama is: automation manufacturers seek change first, and manufacturers follow. In other words, the change of face of automation manufacturers is a foreplay of digitization and intelligence.

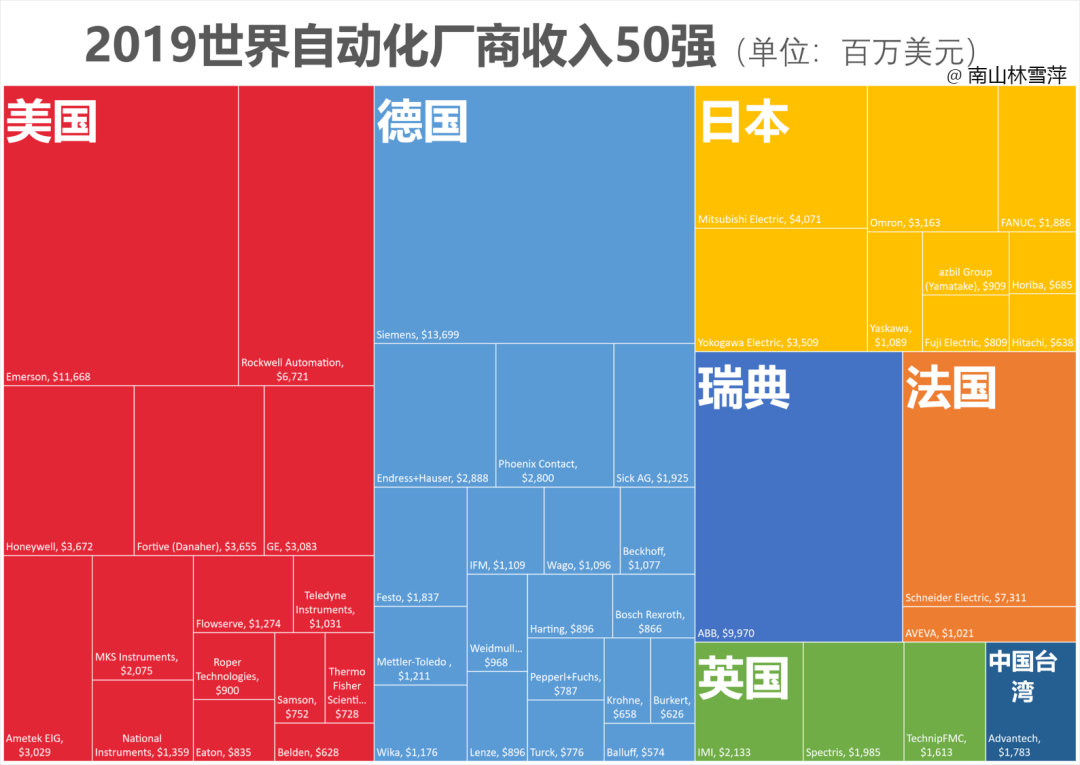

A dull face

In October 2019, control magazine published the top 50 in the field of automation in 2018. Here you can find that the source of intelligent manufacturing is a highly amazing oligopoly market. Siemens, Emerson and ABB occupy the top three (ABB's official website claims to be the second in the industrial automation market), followed by Schneider, Rockwell and Mitsubishi Electric. In the top ten, the United States occupies four, Japan has three, Germany, Switzerland and France have one each. However, judging from the number of top 50, Germany is undoubtedly the largest automation power in the world. 19 companies have entered the top 50, while Siemens ranks first with us $13.7 billion. The third is Japan, with 9 companies. What many people may not expect is that the United States ranks second, with 15 companies, more than 30%, followed by Germany. When we all think that Germany and Japan are manufacturing powers, we must know that the United States is also a superpower of automatic manufacturing, surpassing Japan.

Figure 1: country statistics of top suppliers

(source: control magazine)

Germany, the United States and Japan have arranged 86% of the global top 50. France and Britain basically took all the rest. (Huichuan company, the big dark horse of China's automation, is not included. Huichuan's sales in 2018 were 5.8 billion yuan, which should probably rank about 40th. This may be due to the lack of popularity of Huichuan in the international market).

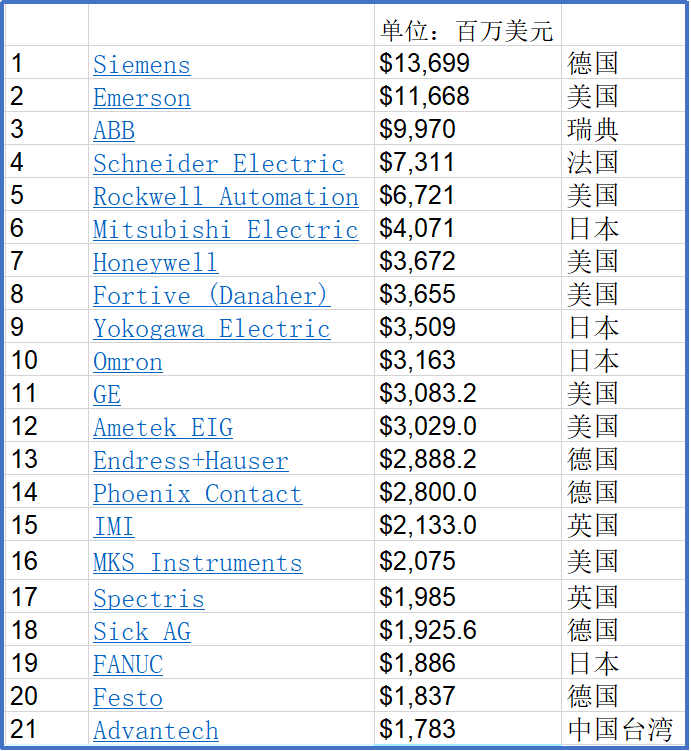

Figure 2: automation ranking top 20

(source: control magazine)

This authoritative media in the field of automation evaluates the global automation manufacturer top 50 every year. But the ranking has not changed much. The automatic three strong lines remain unchanged: Germany, the United States and Japan. Although the automation market has undergone major technological changes, those who want to see the excitement will always be disappointed.

There are no unpopular stories in the field of automation. The leading position of leading suppliers is always as stable as a rock. Traditional large suppliers such as Siemens, abb, Emerson, Schneider Electric, Honeywell, Rockwell Automation and Yokogawa continue to dominate the automation field, as stable as Mount Tai, and even show no sign of shaking.

It barbarians dig the corner of automation

Since August 2018, the software appetite of Internet giants has invaded the territory of established industrial manufacturers. Industrial automation has been infected by it manufacturers, and more ambitious software giants have broken through the gate of the factory and flocked to it. Google, Amazon and Microsoft have announced their intention to provide data storage and related services to the oil, gas and other process industries. If Microsoft's windows interface has been deeply cultivated in the industrial field for many years without being noticed, the power represented by Google and Amazon is "the good does not come".

Amazon cloud service company AWS will provide services for the professional field of oil and gas. Where are their best employees from? As you can guess, they prefer the senior employees of Ge, Schneider, aveva and Emerson. Microsoft and Google also like to recruit employees in the automation ecosystem.

Of course, oil and gas are just the beginning. There are no special barriers for chemical, pharmaceutical, public utilities and other manufacturing industries.

A chill should have risen behind automation manufacturers.

However, the barbarians who broke through the door had no attachment to hardware. The hardware business of automation suppliers, from control valves and motors to sensors, distributed control systems, or Manufacturing Execution System MES, was not much in their basket. They just want to pick up the meat in the basket. What they want is to make data and data services. The most terrible thing is that they want to connect all the data, because only in this way can the value be maximized. Yes, the customer data of traditional automation manufacturers has always been a closed Garden: Although different suppliers are accompanied by equipment on the site, the data are old and dead. Such man-made gullies built by enterprises themselves have created their own wealth. However, this business practice based on "isolation automation" is being besieged by it barbarians. However, barbarians can not succeed everywhere. Good driving in the sky, clouds and falling Phoenix slopes everywhere under the ground. The data console is a universal wrench created by Alibaba cloud. It wants to unscrew the data nuts of each machine. However, although the wrench is well designed, it is easy to break under the King Kong cover of the automation manufacturer. There are pitfalls. These automation manufacturers who have dealt with machines all their lives can find the value of data in new ways.

In the last two years, Honeywell has launched a product called Experion LCN (local control network) to repair it. As early as 1996, it launched the most classic plant wide Control Integration System TPS. If we consider the TDC system of the previous two decades, it is a 40 year repair and connection. It's really a time travel. Elcn combines simulation and visualization to replace the local control network (LCN) which has been used since the 1980s. Elcn allows the original application software and management interface to use the latest network, and can even be made into a locally deployed cloud platform. It is seamlessly integrated with Honeywell's control system PKS and industrial Internet. In the view of large end users, elcn "reset the outdated odometer in the old system". In other words, older users decades ago can now choose to use more modern hardware while maintaining their existing configuration and management software, even though they are very old.

Elcn is a classic of "software activates old hardware", which seems to be a transition scheme, but it provides visualization and reduces coaxial connection, thus saving space. This conservative style of automation is probably not what it manufacturers like. However, large chemical users can tolerate such speed.

It likes industry so much and likes to dig the corner of automation employees so much. This is an annoying cold wind for automation manufacturers.

From Mechatronics to "mechatronics software"

No matter how reluctant the radicals are, we still need to see that the ability of global automation suppliers determines the level of intelligent manufacturing. Intelligent manufacturing is based on automation.

The two most noticeable elements in Digitization: one is the flood of data, and the other is the software of knowledge container. At first, they experienced the panic of it impact, and now they have gradually become the favorite of automation manufacturers.

The data territory in the factory has been dominated by automation suppliers for decades. All kinds of hardware provided by them, including sensors, controllers and software programs, are silently generating a large amount of data, of which only a small part of the data enters the channel of value extraction.

Big data analysis is expected to change this rule. It is now in the early stage of software leading and undermining the established order. In particular, a large number of IT companies have brought users a new set of cost calculation rules and simplified interoperability expectations through the popularization of cloud storage and analysis. In the trickle down, more customers will gradually adopt software based products.

Many automation manufacturers have to be wary of this. Digital transformation comes from the transformation of factory automation, informatization and digitization. However, it is meaningful that the digital transformation first changes the automation supplier itself. All future oriented automation suppliers are accelerating the pace of embracing software.

The story of Siemens' active layout of software has been widely known. In more than a decade, it has conveyed an unshakable saint's belief that automation manufacturers can realize strategic transition only by software. Just as quantum transitions to higher energy orbits must absorb photons, software is the prey of automation. Those slim and relatively small independent software manufacturers have always been the natural prey of big and tall automation manufacturers. Since 2006, Siemens has spent an amazing $14 billion to become one of the top software manufacturers in the world. However, its annual output value is only more than $4 billion. If it wasn't supported by coarse automation hardware, it would be a bitter situation. However, with software, the story of hardware can be told well, and the price of hardware can be sold high after packaging. I believe that the hardware department of Siemens is angry and hated but inseparable from the software business department. Fighting between departments is essential, but it conveys the unity of digital upgrading. This is the focus of strategy, and it is also the best strategy lesson Siemens can teach traditional automation manufacturers.

Schneider Electric is also actively making layout. In 2013, it acquired Invensys and easily won a basket of good dishes such as DCS system Foxboro, configuration software Wonderware and safety Triconex. If this is the internal acquisition of automation, then its attention to PLM design software makes the relationship between software and automation clear. After missing the best opportunity for PTC (PTC is really the "dream lover" of automation manufacturers), Schneider Electric completed the "reverse acquisition" of aveva in 2017 and retained 60% ownership of the combined portfolio. Aveva is also the pioneer of the earliest computer design software CAD, with a strong team left by mathematics in Cambridge, England. It eventually becomes the key design software of engineering information systems such as workshop and shipbuilding. After the acquisition of aveva, Schneider Electric also injected all the previous Wonderware software into aveva. The integration of design software and automation software will be the standard configuration of automation manufacturers. This merger is a set piece outside the goal restricted area, which has decisive strategic value. In 2018, Schneider Electric again acquired IgE xao group, which focuses on electrical CAD and simulation, and used this strategic positioning ball more skillfully and freely.

The latest news is that Schneider Electric plans to acquire German construction software developer rib software company with 1.4 billion euros in February, which is approved by shareholders such as Jing. This means that Schneider's "electrification and digitization" in the construction field continues to run fast. Half of Schneider's revenue comes from the sales of construction and data center products, and the future construction will be all digital and all electric. In this case, the cloud based products of German rib are very important for the field of digital construction and operation. Schneider is elaborately building aveva, an industrial software group. However, at present, rib should not be incorporated into aveva, but a new general fighting independently. This will lead Schneider Electric to another big game. Last April, Schneider Electric and Carlyle, Carlyle investment group, planned to establish a joint venture called alphastruxure to carry out the design and engineering of distributed energy and Microgrid. The two have previously formed a strategic alliance to deploy microgrid in large-scale infrastructure projects. This time, it means that the deep integration of building information model BIM software will completely change the traditional appearance of infrastructure. The national development and Reform Commission announced the concept of "new infrastructure" in late April, which surprised people. In addition to 5g, Internet of things and satellite network, the new generation of information infrastructure also includes industrial Internet. What a conceptual mess. Take a look at the practice of Schneider in France in order to better understand the new infrastructure. The cement and steel bars reactivated by the software have brought new vitality to the traditional infrastructure.

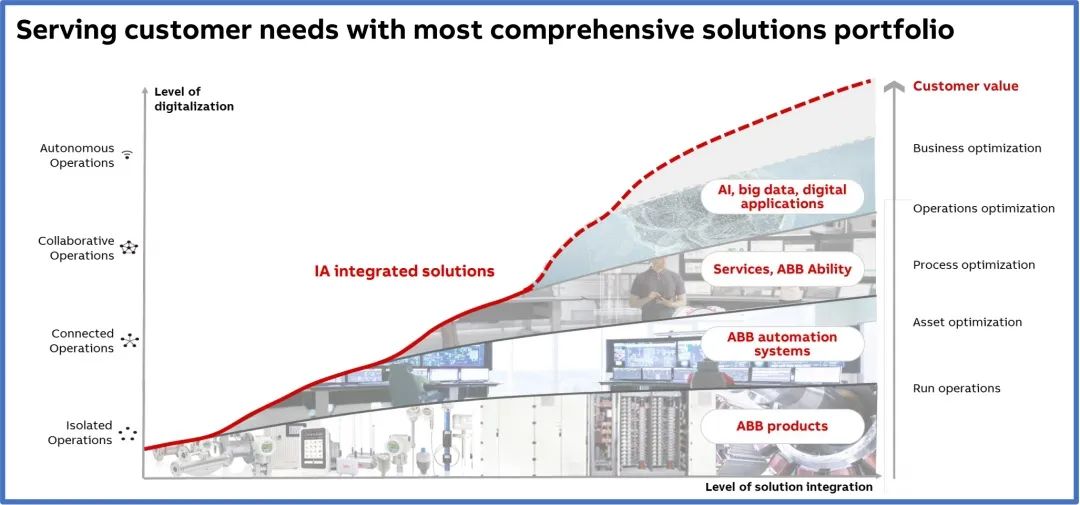

ABB's performance was unsatisfactory. In the automation market of automation, discrete control and robot, ABB's annual report shows that the sales volume in 2019 is about 10 billion. Without the acquisition of B & R, ABB's performance in the digital field can only be expressed in bad terms. The elephant is either a little tired or dazzled by the robot's success. It was not until the acquisition in 2017 of bagalai, a highly cold automated Lone Ranger from Austria, that the current situation was brought back to half its position. Although B & R's annual revenue is only about US $600 million, its outstanding performance in high-end PLC and automation software is definitely the best prey for large automation manufacturers. These small automation companies have always been experts in Jianghu. They are often merged only when the family founder is tired or other accidental opportunities. With such a baby, abb automation has a bright color in the field of automation software. After that, it still took two years to complete the matching between ABB Robot and baccalais software. It seems that integration is not easy.

Figure 3: ABB industrial automation hierarchy

(source: ABB annual report 2019)

ABB's latest strategic patch comes from the strategic cooperation reached with Dassault at the beginning of last year. ABB conducts modeling and simulation before delivering solutions to customers. Digital twin and other technologies will be gradually introduced into ABB's four sectors. However, this kind of cooperation, just like its cooperation with Microsoft and HP, can not explain too many problems. There are many alliances in the Jianghu. Embedding products into each other only makes the user experience better, and will not make an automation enterprise improve its strategy in essence.

Software is not Japan's strong point, but it does not affect the sudden energetic and calm layout of Japanese automation manufacturers. 2016 was the most dynamic year for Yokogawa electric, which changed the brand shape through a series of software acquisitions. These include industrial Tianyan ie (cloud based, shared as a service plant data), KBC (process simulation and consulting services for oil and gas), and SVM (energy management and optimization solutions). Yokogawa motor then integrated SVM and ie into KBC to realize the simulation of oil and gas engineering, which has also become the pillar of Yokogawa's new software. In May 2019, Mitsubishi Electric wholly acquired iconics, an American automation software developer, to strengthen the capabilities of man-machine interface, Internet of things and data analysis in industrial and building automation. The company, which has installed 350000 sets of software, is part of Mitsubishi Electric's efforts to enhance its software capabilities in areas such as edge computing.

From the 1970s to 1980s, Japan proposed mechatronics, also known as mechanical and electronic engineering, which is the combination of mechanical engineering and automation. It has completely changed the face of mechanical automation in the past. Now, software technology is integrated with electromechanical integration, which I call "electromechanical software". No automation manufacturer or manufacturer can get rid of the impact of "electromechanical software".

Based on the strategy of software priority and conforming to the trend of "electromechanical software", automation manufacturers have become beyond recognition.

Or add or subtract focus on the main channel

In some cases, many large suppliers are undergoing reform, reorganization and even "de diversification". In 2019, Siemens finally resolutely divested its natural gas and power businesses. The stripping of siemens energy is becoming the focus of this year. It is expected to complete the company's public listing in September this year. The current CEO Kaisa was nominated as the chairman of the supervisory board of siemens energy, and the CEO has long been determined. Even the current CFO of digital industry group (DI) was sent along. New domestic companies have also been registered.

80% of ABB's grid business was also sold to Hitachi in December 2018; Ge gave up most control of Baker Hughes without suspense - a business that cost Ge about $34 billion.

Honeywell, which ranked No. 7, separated its home product portfolio and Adi distribution business into a resideo company focusing on smart home with an output value of $4.5 billion in December 2018; The transportation system has also been split. Honeywell itself has paid more attention to characteristic materials technology group (PMT), whose Honeywell UOP provides technical and software services to the global oil and gas industry; The process control department is an industry pioneer in software based automatic control systems, instruments and related services. Separation is to better focus on industrial automation and software services.

M & A is the main melody to maintain the market. Taking spectrics, a British instrument company, as an example, the number of mergers and acquisitions has reached 40 in the past decade.

Figure 4: spectrum M & A

(source: spectra 2018 annual report)

In 2015, Omron acquired adept, the largest industrial robot manufacturer in the United States, and delta tau, a multi axis controller, for us $200 million, and entered the robot industry with small load. Compared with the previous discrete component products such as partial component level sensors, measuring instruments and PLC, the acquisition of robots makes Omron's product form more integrated. The artificial intelligence training robot that can play table tennis has become the image spokesman of Omron's factory harmony. In 2017, Omron again purchased the US based industrial bar code reader and machine vision maxken for us $157 million. This full line expansion of the production line is behind the overweight of Internet of things technology. Almost all objects on the manufacturing layer, including raw materials, equipment and robots, began to be connected.

Coincidentally, Mitsubishi Electric wholly acquired realtime robotics, an American robot startup company, in 2019. In terms of robots, Mitsubishi Electric launched Melfa series industrial robots, and added vision ability, force sensor and artificial intelligence technology to realize high-speed and high-precision pickup and control solutions. It is expected to see Mitsubishi Electric's new industrial robot system this year.

These silent focus is the core industry of automation, and motion control is the core cornerstone. Of course, the rapid development of technology is also generating some new challenges in the traditional business model of automation suppliers, one of which is how to transition to software management services. Increasing the size of the company and filling the gap of automation products still exist, but focusing on software restructuring business seems to be a more interesting Sudoku game for automation strategists.

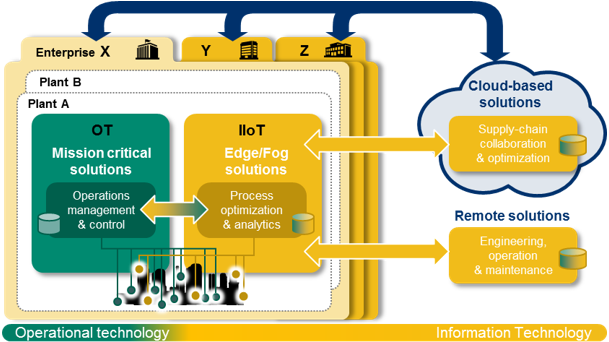

Saving strategy of industrial Internet platform

Each major supplier has an IOT strategy, including their own cloud services and a comprehensive digitization plan across the range of their software products. All vendors are pursuing their own iiot and digital strategies and solutions. ABB has ABB ability; Emerson's PlantWeb; Honeywell's connected plant; Connected enterprise of Rockwell Automation, ecostruxure of Schneider Electric, mindsphere of Siemens, and Ge predix, a young master.

In fact, the application of these scenarios does not have to be complex. Emerson's PlantWeb digital ecosystem plays a role at the sensor / actuator level of the industrial Internet through Microsoft azure. Through analysis and application, it enhances the in-depth understanding of assets and plant performance, and reduces the complexity of wireless installation, commissioning and connecting equipment.

These platforms, or simply solutions, are all called industrial Internet platforms in the Chinese market. Chinese players are playing with the wind and water, but in the actual promotion and application, these international automation manufacturers still show an extremely cautious attitude. After several years of honing, the thinking of automation manufacturers has been basically clear. In terms of strategic positioning, the industrial Internet platform has established the status of Prince and will be the future prince.

Figure 5: Yokogawa Electric's industrial Internet scheme

(source: official website)

With the introduction of virtualization technology and digital technology, users are becoming familiar with the value that commercial it and computing technology can provide. The typical gap between IT technology and operation technology can be narrowed from the previous 10 years to just a few years. This digital transformation may be driven by users. This is obviously different from the previous technology. Oil giant ExxonMobil users have promoted the movement of open automation opaf. This movement can be seen as a "betrayal" of Emerson, the overlord who occupied the large-scale process control system. The latter closed DCS control system and it architecture do not give fresh air based on cloud computing a crack that can penetrate. This institution is developing rapidly, and Emerson chose to quit opaf willfully. But if opaf goes well - a very obvious fact, Emerson may have to embarrassingly rejoin in the future. All these make automation manufacturers have to embrace and beware of cloud computing manufacturers.

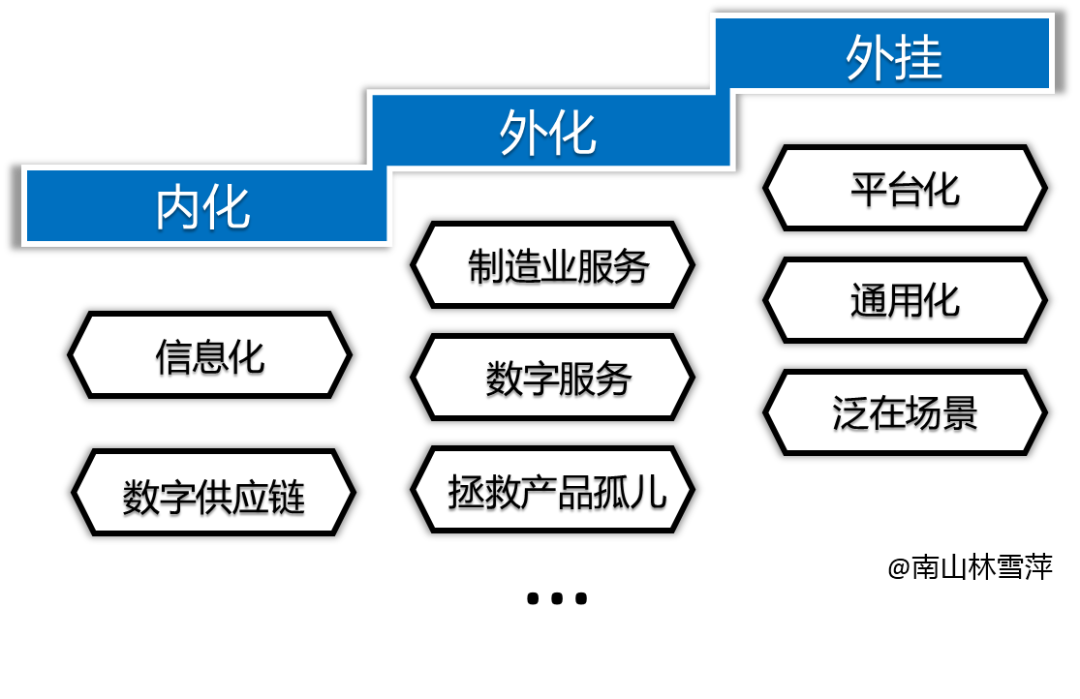

It still takes time for these changes to occur. And what is missing is the credit of the industrial Internet. Naturally, the potential of industrial Internet platform cannot be underestimated, but the rapid development is prone to be all inclusive and messy, which covers up the complexity of the core basic problems of industry. The development of industrial Internet has its own historical track, which can be called the syllogism of "internalization, externalization and plug-in": the internalization of enterprise business processes, the externalization stage of manufacturing service integration, and the platform plug-in stage of enabling the industry. (link:Syllogism of industrial Internet)

Figure 6: Industrial Internet syllogism

The positioning of foreign automation giants as "depositors" of the industrial Internet platform is a strategy that can be attacked and defended. Obviously, they are all in the stage of "internalization and externalization". This is a short lesson. Four years ago, Ge digital's 26000 people entered the "plug-in" stage with predix. Many automation manufacturers also have the same envy and strategic impulse: Honeywell's Internet of things platform has been repeated many times, and the strategic height of Siemens mindsphere has been up and down. Finally, with the gloom of predix, it withdrew to the "outsourcing" stage in a low-key way. Last year, it provided P & G with GE predix manufacturing data cloud MDC, which is a very good breakthrough. For these giants, it is better to serve major customers first. What empowers the industry can be said loudly, but not done immediately. The foreign industrial Internet platform is a tiger's skin on the wall, which can stand worship but can't stand scrutiny. Because looking carefully at the past, the names of some enterprises' industrial Internet platforms are even cloaks used many years ago. However, there are still many new elements to join in. As a platform for "Internalization" and "externalization", it is still an excellent strategy. The Internet of things platform has naturally become the standard configuration of automation giants. Many interesting things are happening, but that is not the main battlefield.

From enterprise cloud to enterprise edge

The key to the development of industrial Internet lies in the awakening of industry itself. Enterprises on the cloud are more likely to be criticized as aimless from China's practice. This is more like the unilateral promotion formed by cloud platform providers with other abacus and overly enthusiastic policies. The factory still calculates the feasibility of cost-benefit according to the actual needs.

For many data collected by the Internet of things, if cloud processing is adopted, there will be many concerns: speed, security and necessity. Edge calculation makes these better processed. Even from the results of telecom operators who have vigorously promoted 5g in the past two years, users pay more and more attention to the data results of edge computing. This also enables automation manufacturers to find a feeling.

From the general trend, the edge intelligence closest to machine, control and sensing will become a key position for automation manufacturers. There will be more and more demand for edge computing. Many data are "burned after reading", which will disappear in the moment of generation. If these data are directly introduced into the cloud, it will be a disaster. Edge computing is making traditional hardware begin to process data, rather than just a data channel as before. More computing power is being grafted on hardware.

Advantech has integrated the industrial computer with the lens in the design of the new generation of embedded smart camera eagle eye. Powerful industrial computer is implanted into the camera together with the algorithm. This greatly improves the capability of the controller on the edge side. Omron's visual lens also uses this method to add a lot of preprocessing.

Mitsubishi is pushing edge computing alliance edgecross in Japan, and Omron, NEC and Advantech have joined one after another. Because the edge side needs big data preprocessing. This is one of the most influential impacts that traditional automation enterprises feel from the Internet of things. Automation enterprises must deal with computing power. Edgecross encourages members of the alliance to put some analysis functions on the industrial computer side, which also makes Mitsubishi promote efactory for many years, re strengthen the hub position of industrial computer melipc based on edge computing, and embed multiple functions such as data acquisition / transmission, edge computing and real-time control. Due to the emergence of edge computing, the old guys of PLC and IPC, who were almost marginalized, are rejuvenated, and position C is on the stage.

Motion control systems are also being put on the table one by one. Those traditional actuators are one of the long lists waiting to inject "edge computing" nutrient solution. For example, the slide rails and ball screws of THK in Japan and Shangyin in Taiwan, and the actuators of FESTO in Germany all start to collect data and control through data analysis.

The edge computing power is strengthened, and the data layering effect is obvious. Some are controlling the edge, some are at the end (such as the lens), and more complex ones will go to the cloud. For example, the sensor for vibration analysis belongs to high-frequency data and will not be uploaded directly. Instead, it is necessary to extract the eigenvalue, filter a part, and then enter the IPC. Each link has corresponding data processing means, and behind this is an in-depth insight into industry knowledge. At the same time, with the accelerated popularization of 5g, the popularity of mobile edge computing MEC has also been accelerated. It can be said that 5g has found the business model of sinking factory. It is no longer an independent third-party pipeline, but is likely to become part of the plant assets. Automation manufacturers will not ignore this huge change. Edge computing has become a new star.

This is the most skilled position of automation manufacturers. ICT manufacturers are laymen. It is for this reason that robot manufacturers attach great importance to the progress of this position. Both KUKA and Fanuc have made great efforts. Compared with domestic industrial Internet platforms, these robot manufacturers focus more on the accurate layout of edge computing. Fanuc has made a secondary investment in preferred networks, a rookie of an artificial intelligence company in Japan, in order to ensure that FANUC can continue to consolidate its fortress in the advantageous fields of CNC system, servo system and robot.

At the end of 2017, Yokogawa electric unexpectedly released a brand-new automation brand "synaptic business automation". Synapse is the key part of information connection related to neuronal function. This term, which is not easy to understand, expresses countless decentralized automatic nodes, which will connect without hierarchy and realize the free flow of data. This is a fantasy song for the future automation system. It vividly allows us to think about the transmission ways of communication, control and data instructions in the future automation field, and edge computing will become an extremely busy data port.

The defense in depth of edge computing is an advanced defense card for automation to confront it manufacturers. Rather than "enterprises on the cloud", it is better to say "enterprise support", which can be loved by factory owners. The trend towards edge computing allows automation to regain its confidence in the threatening cloud computing manufacturers.

Process and discrete handshake

The automation trend of process industry and discrete manufacturing industry is close to each other. In the re restructuring plan in 2019, Siemens re merged the process industry separated in previous years with the digital factory, established the digital industry group, and struggled to promote the merger of various departments into a unified business.

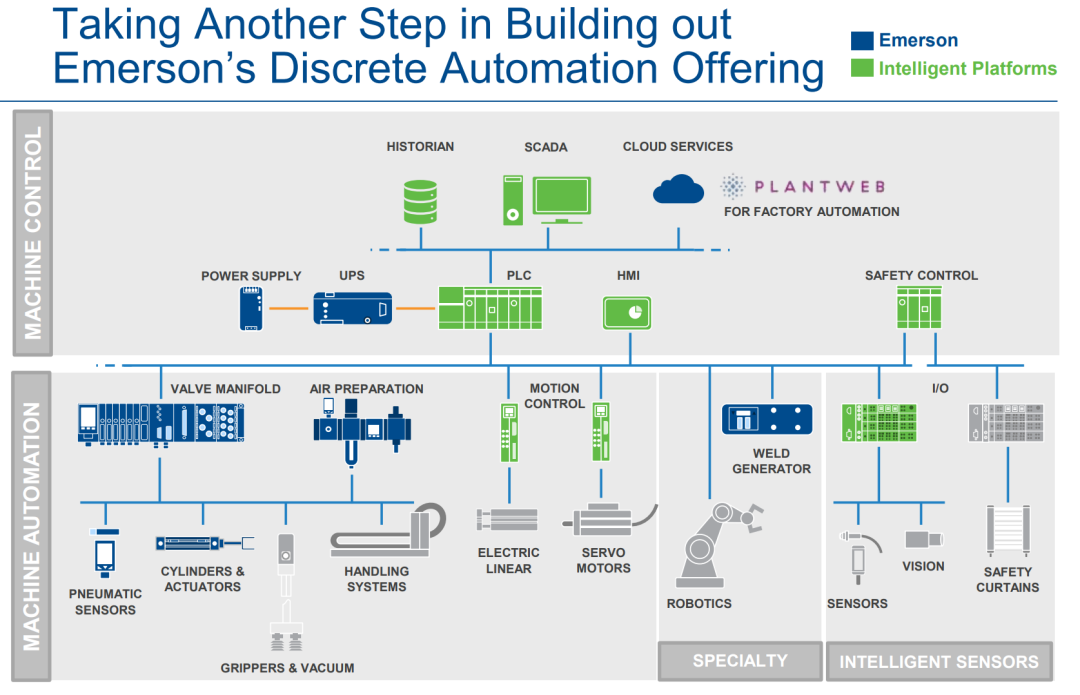

This is also the weakness that process automation giants have always wanted to make up for. The most restless is Emerson, who ranks third in global automation, and has been eager to make some achievements in discrete manufacturing.

Emerson offered nearly $28 billion for Rockwell in 2017, but failed because of the latter's resolute "anti marriage". Subsequently, Rockwell adopted the three handed firm Dharma protection action. First, it quickly launched a large-scale stock repurchase program worth $1.5 billion, thus enhancing its independence; Secondly, invest US $1 billion in PTC, one of the three major CAD manufacturers in the world; In 2019, it will conduct strategic cooperation with ANSYS, the largest simulation company in the United States. I'm crazy about young people. I lead yellow on the left and green on the right. This defensive skill of opening the left and right will make it difficult for Emerson to shoot again. The strategic layout of Rockwell expresses how an automation manufacturer uses software alliance to build its own new trench.

Emerson needs to continue to fulfill this mission of entering discrete manufacturing. The acquisition of GE's intelligent platform business in 2018 also attracted countless attention because it rubbed the popularity of GE's industrial Internet platform. However, Ge intelligent platform is just a business with a revenue of more than $200 million, or traditional PLC, industrial PC, I / O and other related hardware and software and machine control technology. General automation manufacturers won't want this kind of goods, but Emerson has to bend down and pick it up. Who makes himself weak in the field of discrete control. If you had known today to retrieve GE's man-machine interface system Cimplicity, why did you lose Jingzhou carelessly in the past. Invensys sold Wonderware, the flower of man-machine interface system, to Schneider, who armed it from a small software business department into an independent brigade, and finally loaded it into aveva, which is simply a reinforcement division. Automated predators generally won't capsize as long as they don't annoy it too much. Of course, occasionally splashing a little mud soup is also indispensable.

Figure 7: Emerson's intention to acquire Ge intelligent platform

(source: Emerson's acquisition of Ge IP)

In the same year, Emerson also acquired avics, a supplier of automatic pneumatic technology, at a price of more than 500 million euros. I can't help but say that this brand has a long story. Originally the Department of Mannesmann, an old German industrial giant, Bosch automation acquired Mannesmann's Rexroth in 2001, while the pneumatic department under Rexroth ran away from home and operated independently in 2013. This is also a leader in power equipment and fluid automation, with annual sales of more than 400 million euros, and Emerson started with almost parity. He really found a jump price.

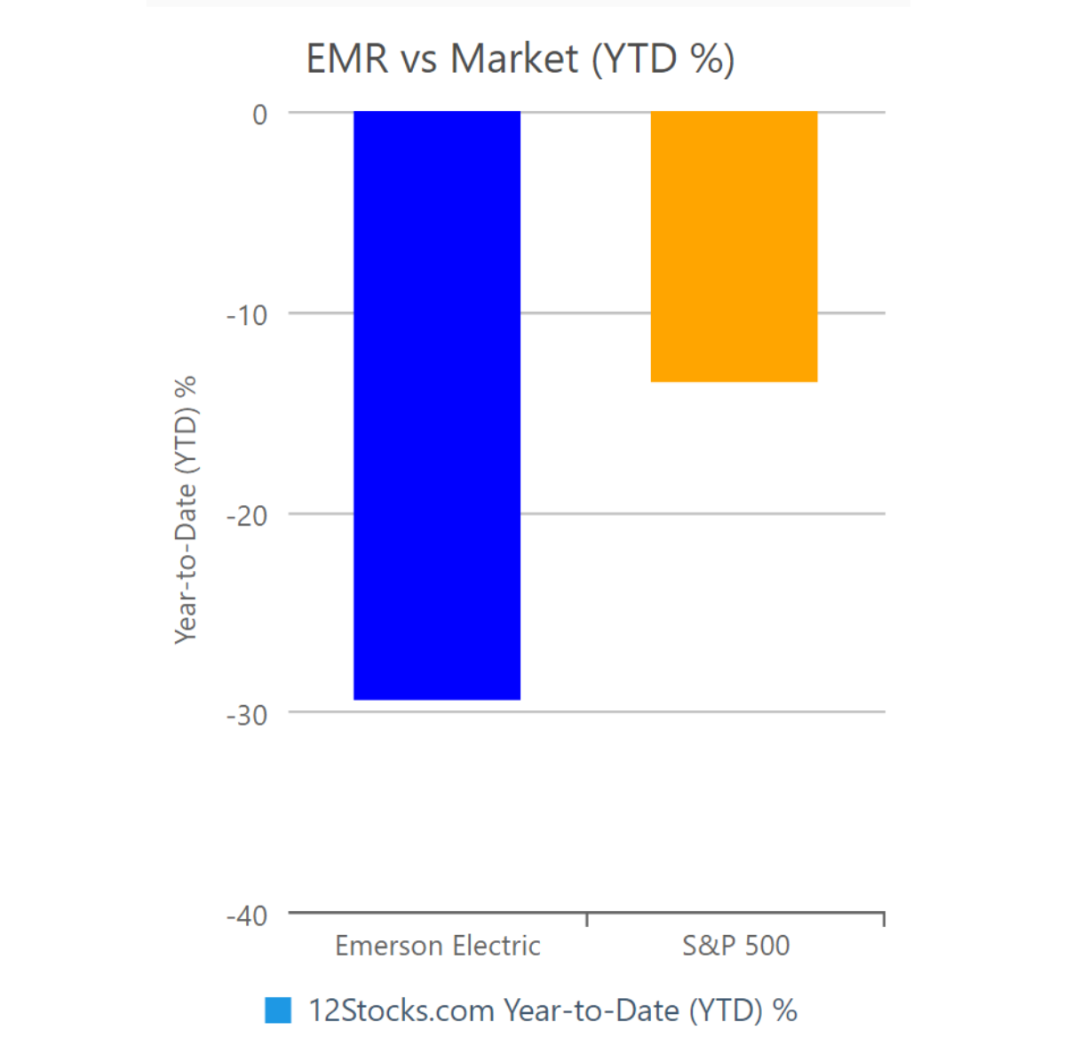

Figure 8: Emerson's stock return in one year

(April 25, 2020)

But Emerson's market share price is not good. As of last week, it fell nearly 30% in a year. Nevertheless, Wall Street stock market is still full of confidence in Emerson. This is probably the magic of automation enterprises.

There are many automation companies in discrete and process industries. With the power of Internet of things and cloud computing, including the penetration of distributed MES, the distance between these two different industrial industries is closer than ever. This also tests the new strategy of automation manufacturers.

Awake middish and later catfish

When large suppliers are dominated by diversified businesses and their leading position is as firm as a rock, medium-sized suppliers tend to focus on specialized businesses and forge ahead. AMETEK, a global leader in electronic instruments and electromechanical test equipment, has an annual sales of about US $5 billion. The German enderhaus E h instrument and the German beijiafu P F sensor are all full of vitality in the digital age. These companies are also repeating the story of large suppliers and actively welcoming the changes of the times. Taking Phoenix Contact of Germany as an example, this electrical and automation company, which started with wiring terminals, has moved towards the digitization of software and hardware integration through the plcnext software open platform integrating OT and it, while the charging solution for charging pile conforms to the trend of global re electrification. These are the inevitable conditions leading to the future. Conversely, it can also explain that the strategic route these medium-sized automation suppliers need to choose on the road of intelligence and re electrification is not difficult. They seem to have intentionally or unintentionally arranged chess games, which are in line with the development of the times. The rest is just tactical ups and downs. There are no surprising laggards on this road. On the contrary, they are more alert than any other player.

The market is as stable as a rock, and the middle game is calm. On the chessboard of those small players, there is another scene of wind and water. Smaller, independent companies are booming, and start-ups are emerging one after another. Network security and data analysis have become the nursery of the new company.

These small start-ups are often very focused, and big data and security attack and defense are their paradise. Hundreds of such companies are emerging. Dragos, seeq, etc. are all related to network security, health, safety and environment (HSE). The driving force for the adoption of Internet of things technology often comes from the IT aspect of the business, but there are unprecedented vulnerabilities before the real integration of it and ot. The industrial network security strategy must give priority to completely solve this problem. In this sense, security in edge computing has a much higher priority than time sensitive network TSN, OPC UA and other technologies. Due to the expanding scope and impact of network attack threats, large automation suppliers are struggling to cope with network security. At the same time, these start-ups entering the network security market come at the right time.

Data analysis companies and machine learning companies are also popular. Traditional machines and equipment suddenly burst out so much data, which is a distressing thing for maintenance personnel and factory IT personnel. Large cloud computing companies that step on auspicious clouds from the sky can not solve the scattered data analysis needs at the bottom. However, these cloud computing companies have opened the managers' thinking holes from top to bottom, and split the shell of the machine with great surprise, and the data bloomed like open pomegranate seeds. Those data catcher companies that focus on the Internet of things or data analysis and are naturally fed on data are waiting for such a moment. When the machine roared and the pomegranate opened, it was their happiest meal time.

These industrious data catcher companies can easily grow rapidly. Some of these suppliers may even cause serious competition to traditional automation suppliers. But it is more likely that it will be later acquired by the vigilant automation company. These vigorous start-ups can make automation manufacturers live better. When the small fish grow to the right size, the big fish will eat it with one mouth.

As a result of this competition for freedom, there are more and more commercialized software, from data storage, to data calculation, to data closed-loop and even control. The business model is also subverting. The IT service model with software subscription as the source of revenue is entering the field of automation. Every little place is changing every day.

Notes

It has always been a sunny day over the automated ocean. There are a lot of new things, but the players of top suppliers have basically declined. Now, there are many new faces. There are already familiar but more determined it manufacturers, semi familiar Internet of things and unfamiliar data analysis rookies. However, the crowded waterway still looks orderly. The rough waves are all below the sea level.

Automation manufacturers themselves are becoming beyond recognition, and transformation is quietly under way. However, don't misunderstand that they will be absent: those once legendary names are still wandering in the Jianghu, and there are no bends on the road of intelligent manufacturing. Over the years, the east wind dance, still yesterday's peach blossom smile.

Copyright © Shenzhen Kinghelm Electronics Co., Ltd. all rights reservedYue ICP Bei No. 17113853