-

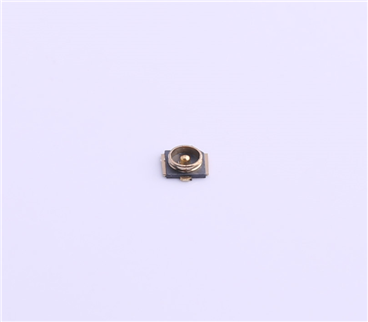

- RF Series

- Connector&plug-in unit

- Plug-in unit

- SD card holder

- SIM card holder

- Thimble /wire protector

- Crimping terminal

- Waterproof joint

- 短路帽/跳线帽

- 压线端子胶壳

- 屏蔽夹

- Waterproof and dustproof terminal

- Industrial&automotive&military

发布时间:2021-12-31作者来源:金航标浏览:2704

The sky is full of stars and the earth is full of fire

Germany's second largest software supplier may be acquired? The news at the end of November was really earth shattering. Software AG, founded by mathematicians as early as 1969, is facing the possibility of sale. This software for enterprise information system is facing the difficult dilemma of slow revenue growth caused by unfavorable cloud. And excited investors are flocking like sharks smelling blood. 2021 is an extraordinary year.

2021 is also a bright moment made in China, and industrial software has also ignited a fire never seen in history. First, Guangzhou Zhongwang, a CAD manufacturer of design software, landed in the stock market in March and became the first industrial design software company to win the stock market; Huada Jiutian, the leader of EDA in Chinese chip design, which began to apply for IPO in June, won the qualification for approval in only three months.

This is just a small corner of capital. Capital eagles are flying everywhere in the land made in China. They hover and dive at low altitude, looking for every possible prey. Those industrial software entrepreneurs who have worked hard for many years continue to struggle and meet waves of capital waves. This soil has never been so lively. The night was lit by the heat.

In foreign countries, M & A plays are staged one after another.

M & A of industrial software is the most important weapon transaction in the journey of intelligent manufacturing, which is the key to success in the future. It was the samurai who were about to go to a bigger battlefield and bought themselves one brand-new sword after another. They know they must need it.

There is no boundary, and the paradigm is established

In 2021, Emerson Electric, the world's largest process automation company, acquired Aspen, the world's largest process software company. Hard to imagine, it sounds like Boeing bought general motors or Foxconn bought canon. Not impossible, but too subversive. It is a meaningful advertisement for both the automation market and the industrial software market. Automation and industrial software are merging at an amazing speed, changing each other's face. The sound of their handshake will shake the whole process industry. Whether it is petrochemical industry or electric power pharmaceutical industry, enterprises will find that the alternative software platform for intelligent manufacturing will be narrower and narrower.

After this service, the boundary between control system and industrial software disappeared. This is the order established by a series of events. The last acquisition was in 2017. Schneider Electric acquired 60% of the shares of Jianwei aveva, a process engineering design software, at a price of 5 billion yuan, and injected its own dowry, which is called reverse acquisition. Emerson's acquisition of Aspen was basically based on this sample. After all, Emerson was also one of the pursuers of Jianwei at that time. The initiator of this paradigm of automation and software cooperation is UG company, which was acquired by Siemens in 2007. From the automation giant of discrete manufacturing to the boss of process automation, three campaigns span 15 years, completely filling the gap between control system and industrial software. Emerson's acquisition means that the independent fate of most third-party software has basically come to an end. As an industrial software company with sales of US $600 million, Aspen is the overlord of the process simulation industry, but it is insignificant in front of a star such as a larger automation giant.

Emerson bought 55% of its shares with 40 billion yuan in cash. The merger of the two is like a collision of planets. The dazzling light illuminates the pattern of the process industry. Every downstream user enterprise has been working hard to break all kinds of automation islands and information islands. Now these isolated islands will begin to disintegrate. Because they are at the source, they will be merged and opened up by suppliers.

Is it joy or sorrow? One day in the future, users may miss the era of isolated islands. When the upstream suppliers connect the information system, it means that the industrial software is going to be invisible and platform. At that time, users will wake up and find that they are losing their bargaining power more and more.

This gamble, Emerson is by no means a naked purchase, and it has a lot of industrial software cards. Among its revenue of 110 billion yuan in 2020, the revenue of independent industrial software is 8 billion yuan, that is, it holds a "unicorn" in its hand. Emerson plans to give his two software companies, including a company doing geological simulation, as a dowry to Aspen tech, the bride, who will immediately have an income of 7 billion yuan.

One of the dowries is OSI, which Emerson acquired with more than 10 billion yuan a year ago. This company, which makes power monitoring software, has only 1000 people, but it is a sentinel of power system stability. Obviously, Emerson is trying to move from the control system of power production to the field of power transmission and distribution. Once photovoltaic and wind power, these unstable renewable energy, enter the power system with unpredictable load, it may cause great disorder. Clean is not always popular. Renewable energy is still regarded as a "troublemaker" by the power grid system that has long established a stable order. In China, the renewable energy connected to the power grid is less than 8%, and it is this 8% and its subsequent sustained growth that really makes the power system face the enemy. Emerson Electric's industrial software layout is based on the logic of such a new era of renewable energy. Just like a free hand in go, its strategic value will only be met at the later confrontation time. The ability to monitor and optimize the power grid in real time also means that Aspen will move from the factory to the distribution service market. End to end service for enterprise operation is becoming a new highland of industrial software.

Although he is the first leader in process simulation software, Aspen also has a great sense of crisis. Its competitors, whether ProII or UniSIM, have already taken refuge in automation giants Schneider and Honeywell. Independent racing track is no longer popular, and there are mixed Ironman races of water, land and air everywhere. Industrial software joining automation companies is an industrial attribute, such as the best choice; Emerson, Honeywell, Siemens and Schneider have become more and more like each other in the fight in the industrial field.

This is the logic of industrial evolution.

Cloud primordial

In June this year, the automation company Rockwell acquired plex systems, a cloud MES and ERP company, or SaaS company, for 15 billion yuan. Rockwell also has strong MES software at home, but it's still too cumbersome to move to the cloud. The difference between cloud native software and traditional stand-alone deployment software is even better than the similarity. Like domestic ducks and wild ducks, that is the difference between flying and not flying. The acquisition strategy of a company is the disclosure of the bright spring light of the strategic map of the board of directors. Automation companies such as Rockwell are obviously migrating to the cloud with high tension.

The strategic intent of such action is consistent. In January, Rockwell completed its acquisition of asset management software fiix. Similarly, this is a cloud native company located in Canada. Compared with Maximo, the top asset management software company acquired by IBM many years ago, the deployment of fiix is much lighter. With such software, automation suppliers can charge by month. This is the most ideal income model. From automation to industrial software and cloud native software, the three links complement each other.

This can not be achieved at once. Some automation manufacturers have lagged behind. At the end of last year, Delta, which is good at automation hardware, acquired trihedral, a Canadian SCADA configuration and industrial Internet of things software company, and officially listed its industrial configuration software vtscada in the domestic market. This software, which has been used in the fields of water / wastewater, oil and gas and energy for more than 30 years, is just perfect for Delta industrial automation hardware. However, this PC software is only a long overdue replacement for Delta. Currently, cloud SCADA is in full swing. Delta needs the next prey to really face the future.

Germany tongkuai, the world's largest machine tool and laser manufacturer, has focused its digital energy on software for shopping networking and information system interface in the past two years. Cloud native software is an important exciting point. For tongkuai, the potential of a single machine has long been exhausted by the mature German manufacturing system. The real potential is the optimization of online equipment and production line in the future.

Automation liberates manpower, which is labor saving; Industrial software should liberate the human brain, which is the improvement of insight. This is the basic logic of automation software and industrial software. The cloud native software, with flexible computing power and rapid deployment, makes the previously bulky machine elephant lighter.

New model of Japanese manufacturing

Who is the new model made in Japan?

Sony first, Hitachi second. Sony has completed its transformation, including entertainment, electronics and manufacturing. Although it is no longer the chivalrous face of the magical Sony black technology in the past, its profit is amazing. It is estimated that the annual sales in 2021 is expected to reach 550 billion yuan, while the operating profit is expected to exceed 50 billion yuan. Sony has almost become the most valuable stock in the Japanese stock market.

Another example is Hitachi. Unlike Sony's entertainment route, Hitachi is still making new tricks in the manufacturing industry. Hitachi is the star of Japanese industry in recent years. Because it seems to have declined in the past few years. The new president is the star of saving the sinking ship. The biggest action is the investment in industrial software. Not to mention its massive absorption of Ge predix personnel, this is just a small episode. In March this year, it announced its acquisition of global logic Inc., an American supply chain software company, for us $9.6 billion. At the same time, it actually gave up the deep hole cutting tool such as Hitachi metal, which lives alone in the field of fine hole processing, and also gave up the booming business of battery anode and cathode materials. Focus on soft and future. This is the idea of Japanese model students.

It's not lonely on the way forward. At almost the same time, Panasonic of Japan acquired blue yonder company of the United States for us $6.5 billion. This so-called artificial intelligence company is actually a supply chain company, with an annual revenue of US $1 billion. Panasonic plans to combine such software with its own sensors, RFID and other hardware to release new magic.

Japanese manufacturing is hard manufacturing. In the past, it was generally a manufacturing representative with one-time sale products as the main body. Now, Japanese manufacturing pioneers want to get annual recurring revenue from subscriptions. Since ancient times, Huashan has been a road. Only industrial software can change the original business model of manufacturing industry established over the years.

Switch game combination

Siemens digital industrial software has experienced the puberty of opening and closing, and now it has entered a mature adulthood. Annual acquisitions are routine and basically continue the state of repair. For example, onespin, a German formal verification software supplier, was acquired in April to help users ensure the integrity of integrated circuits. This is just to add a piece of armor to the three EDA software mentor in the world. Siemens industrial software has built a huge xcelerator software castle. On this basis, it strengthens the concept of "application priority" and creates a complete verification platform, including simulation, formal verification, hardware simulation and prototype verification. However, in the vertical industry, Siemens industrial software still has many weaknesses to pull back. In May, Siemens digital industrial software acquired the ship design and simulation software foran of a Spanish company. Siemens has built a rich industrial software system and has solid advantages in automobile and machinery industries. However, in the field of shipbuilding, it faces two mountains: Schneider aveva, which acquired TRIBON, and Dassault system, which comes from behind with 3D model. Through the acquisition of foran, Siemens expects to continue to fight guerrillas in the shipbuilding industry, at least not leave this position.

In terms of industrial software, Siemens' exciting focus is not on this department, but on how to transform its traditional business, such as the Intelligent Infrastructure Group Si, which accounts for 1 / 4 of Siemens' total revenue. It has sales of 14.3 billion euros in 2020, but its digital business revenue is only 5%, and is looking for a variety of exports. The annual growth rate of the electric vehicle industry is 30%. Electric travel is naturally a major area of interest to Siemens Si. As of August, Siemens has spent US $660 million on the acquisition of software business in the travel field and US $700 million on the acquisition of electronic component supplier supplyframe. Siemens Si Group also aims at building digitization, which actually has a market growth rate of only 3%. However, there are many expectations for the renovation of the stock market. Intelligent building tests the integration of various systems, and garden and building management software is becoming more and more important. The profit of software business is naturally higher than that of product business. Siemens is working hard to expand software and services such as control grid, access control, heating and lighting. In the next step, Si Group will seize market share from competitors such as abb, Schneider Electric, Honeywell and Johnson Controls. The only hope is software. The opponent thinks so. As far as hardware is concerned, they have been dating and killing each other for nearly a century and have no creativity; In the software duel, everyone is new, and the duel is here. It is very important to increase the software chips in your hand. In October, Siemens Intelligent Infrastructure Group acquired wattsense, a French start-up established in 2017. This Internet of things company provides plug and play Internet of things management system for small and medium-sized buildings.

Of course, such a pen is still too small. Schneider Electric invested 10 billion yuan last year to acquire the old German architectural design software rib company. This time, it directly competed with Autodesk, the earliest CAD design software provider. Revit of the latter once became the embodiment of BIM (building information model), and also challenged Bentley's cake, the number one engineering construction software. However, this challenge is not intended. Schneider Electric is far from considering these pure software companies. It has to deal with industrial automation giants like Siemens. An important basic part of Schneider Electric's revenue lies in low-voltage electrical appliances and building automation, and big data center is also included. Both design and intelligent operation are inseparable from a thorough grasp of building data. Therefore, we have a complete set of architectural design software to solve the digital twin of the building, so that every switch and every electrical appliance can be defined by our own design software. How can we not completely open up the data channel? Bridging the gap with industrial software will give Siemens a longer way to catch up.

Siemens is moving forward and backward. Recently, it is planning to throw out the global traffic light control system. Qingdao Hisense, the first brother of China's traffic control system, is expected to take over with us $1 billion. This is a rather dramatic scene: Siemens plans to engage in the business of mobile travel, while the business task of roadside guard is handed over to Chinese manufacturers. In the urban construction of Beijing before the 2008 Olympic Games, Hisense at that time, as an apprentice, squeezed out Siemens and traffic control system giants such as American Tate. If the merger is successful, Shifu will hand over his clothes and bowl to believers made in China.

Merger maniac

Some manufacturing giants did not stop for a moment. They marched late at night and robbed the track year after year. It's easy to ignore an M & a maniac: Sweden's hexcon. The company has completed more than 100 acquisitions in the past decade, most of which are aimed at industrial software, so that people almost forget that it was only a CMM manufacturer ten years ago. The acquisition of five or six CAM software for computer-aided manufacturing has made it familiar with the control of machines.

In April this year, hexcon acquired cradle, a fluid computing software company, which has powerful preprocessing and ultra-high speed solver. This makes it even more powerful in acquiring MSC, the world's second-largest CAE simulation company, in 2018. This kind of dowry act also occurred frequently in the past.

Hexcon also acquired the American Eagle chart company and won the third crown of process plant design software with Bentley and aveva. This has greatly strengthened its ability in space management. Yingtu first started from the early electronic map of urban construction in the United States. Later, it once had a powerful mechanical design CAD. Its solid edge was later sold to Siemens software and became a medium and low-end CAD software. With its software processing of spatial terrain and its inherent hardware measurement ability (including Leica measurement acquired), hexcon has become a leader in urban digitization and factory digitization in the process industry. The main body is determined, and then there are rich accessories. In July this year, hexcon acquired immersal, a virtual reality cloud technology company in Finland, to realize the reproduction of spatial mapping and visual positioning. According to the current gimmick, this is also a part of the meta universe. However, the meta universe of hexcon can really establish the four in one ability of measurement, construction, simulation and reproduction.

Of course, the most surprising thing is that in October, hexcon completed the acquisition of the Enterprise Asset Management EAM business of the famous infor with us $2.75 billion. As the third largest enterprise application software and service provider in the world, infor has only been established for 20 years, but it has completed more than 40 mergers and acquisitions. Collect all the early ERP software, such as fourth shift, Mapics and the classic Baan. Of course, it is another American giant Koch group that opened the biggest blood basin and ate infor. This industrial pluralism with numerous factions is an alternative in the history of industrial development. It is the largest unlisted company in the United States. Its sales reached US $115 billion in 2019 and its diversified behavior is perverse. For example, it is the world's largest asphalt manufacturer, the sixth largest power supplier in the United States, or it is the largest paper maker. Most importantly, it is infor's largest customer. So why not eat infor? In the first half of last year, it bought infor for $13 billion.

In and out, informr's asset management software EAM seems to be ignored. It needs to be better combined with sensors, software and automation technology. This is the advantage that hexcon has gradually established. Hexcon has the design data and simulation data of assets, so infor's asset management software has become its most desired asset.

That's the deal. Industrial order needs industrial software to manage.

The strategy is too simple

Is the digital strategy complex?

No Just select an industry and buy software desperately. At least for Honeywell. In September this year, Honeywell acquired performix to enhance its digital automation capability in the field of life sciences. Performix is an MES manufacturing execution system software that helps pharmaceutical and biotechnology customers optimize complex manufacturing processes.

Honeywell is switching the battlefield and trying its best to kill the life science industry. An integrated software platform is essential. Just last December, Sparta systems, a pharmaceutical quality management software QMS company, was purchased at a cost of 9 billion yuan. The latter's track wise digital and qualitywise.aism will focus on Honeywell forge enterprise performance management software. The company has 200 employees and sales of US $56 million in 2019. This is more than 20 times the acquisition. The products combined with Honeywell experience process knowledge system will meet the needs of life science customers in the product life cycle - from automatic project implementation to optimal production to sustainable quality.

Not alone, Yokogawa electric, Honeywell's old Japanese rival, is doing its best to enter life pharmaceutical. As Japan's largest process automation company, Yokogawa has really crossed the border this time. It has moved from manufacturing to R & D. In September this year, it acquired Germany's insilico, a bioprocess software developer. Yokogawa hopes to build a comprehensive bioprocess solution through this acquisition to support the whole process of biopharmaceutical from development to production.

In the development of new drugs, there are a large number of cells to be cultured in bioreactors, and each cell will produce substances that constitute the active components of drugs. How to monitor the metabolic reaction of each cell, such as the changes of pH and dissolved oxygen concentration, and visualize and analyze it in real time is a cosmic micro level problem. At the molecular and cellular levels, where and what happens?

This is a complex cellular reaction system with a large number of parameter constraints. Insilico's digital twinning technology uses an advanced hybrid model for prediction and simulation to understand cell behavior.

Of course, this digital twin technology can also be used for real-time analysis of production process data, soft detection of nutrients that cannot be measured directly, finding abnormalities in advance and providing guidance for operators. The top digital twin software technology of biological process is organically integrated with the pharmaceutical production system solution of Yokogawa electric.

What is digital twin technology? The answer of Yokogawa motor, which is good at engineering technology, is not very clear and professional, but buy a professional one. This 30 person small software company is the best prey. Like a little broiler, the only reasonable reason for them to walk on the ground is to become an eagle's lunch.

Notes: standard action

To understand how strong a manufacturing enterprise is, it depends on how strong its software capability is. Eight of the top 10 medical device companies in the world have a clear digital strategy, and investing in software is like a wealth that can be locked into a safe. Philips, the global leader in medical devices, acquired capsule technologies in the field of patient monitoring this year, which is a provider of medical device integration and data technology. These software are amplifying the value of the equipment at a high rate.

Obviously, acquiring software is the least error prone strategic action. Light up the software spark and illuminate the road at the foot of the manufacturing industry.

(review of industrial software in 2021: to be continued)

Copyright © Shenzhen Kinghelm Electronics Co., Ltd. all rights reservedYue ICP Bei No. 17113853