-

- RF Series

- Connector&plug-in unit

- Plug-in unit

- SD card holder

- SIM card holder

- Thimble /wire protector

- Crimping terminal

- Waterproof joint

- 短路帽/跳线帽

- 压线端子胶壳

- 屏蔽夹

- Waterproof and dustproof terminal

- Industrial&automotive&military

发布时间:2021-12-31作者来源:金航标浏览:2336

Laser industry, golden decade. China's laser industry exceeded 10 billion yuan for the first time in 2010 and 68 billion yuan in 2020. 2010 is a memorable year for made in China, because it was in this year that the added value of China's manufacturing industry accounted for the first time in the world. At that time, Han Zu, China's largest laser manufacturer, had an income of 3.1 billion yuan in that year, while Han Zu had an income of 12 billion yuan in 2020.

With the rapid rise of China's laser industry, the world is also undergoing huge fission and reconstruction. The most obvious is international M & A, which is becoming more and more intense. The laser industry can be regarded as a three whip structure, from processing equipment to key components such as lasers, and then to raw material devices such as optical crystals and optical fibers at the front end. This seemingly simple three echelon supply chain presents great liquidity. Cross border between upstream and downstream enterprises has become very common. M & A has become the most common business growth format in the laser industry.

Figure 1 three echelon structure of laser industry

2010 can be defined as the first year of China's laser and a new milestone made in China. This is a time node that no international brand can ignore. To accurately understand the strategic focus of an enterprise, the ten-year M & a history starting from the first year is undoubtedly the best yardstick.

Figure 2 acquisition compass of laser Empire

This is a magnificent laser territory.

Active boss: tongkuai

Laser processing industry is a binary complex of machinery and optoelectronics, just like Remy Martin. As a subdivided industrial field, the temperament of the leader is the most worth pondering. Its every move often represents the most profound thinking of the industry. Tongkuai appropriately played this role. Firstly, it perfectly presented the shape of the complex. In fiscal year 2021, the revenue was 3.5 billion euros, the machine tool accounted for 60%, and the laser accounted for 34%. Second, it is so active in the capital market that it is difficult to forget that it is a machine tool company with a history of nearly 100 years, and has 40 years of experience even in the laser field.

It doesn't take ten years to study the M & a history of tongkuai. In the last four years, it has completed more than ten mergers and acquisitions. What changed the fast travel curve was the acquisition of access laser in 2017, whose low-power carbon dioxide laser is the light source of extreme violet lithography. This makes tongkuai the only company in the world that can provide light source for asmaiji violet lithography machine in the Netherlands. Just as Zeiss is the only lens provider, the top locking strategy of German industry and Dutch lithography giants is the next city. In fact, in 2020, tongkuai's sales in the Netherlands are almost close to the U.S. market, which can really be described as "a small company can top a large country".

The layout of tongkuai in the last five years reflects the three directions being presented in the laser industry.

First, laser equipment manufacturers need to strengthen the overall layout of lasers. Through the acquisition of amphos, a picosecond laser manufacturer, tongkuai boarded the train of ultrafast micro machining starting at high speed; Taking HBM, a solid-state laser manufacturer, is to deepen its layout in the field of semiconductor and communication, which will always be a rich market for the laser industry. In fiber lasers, fast communication needs to reverse the adverse situation. Although tongkuai acquired SPI, a British fiber laser manufacturer, as early as 2008, it has always placed it in a relatively independent state. This strategy seems a bit wrong. Tongkuai did not fully seize the opportunity under the flood of fiber laser becoming the mainstream technology. In 2020, tongkuai finally decided to correct this tactical mistake and integrate SPI into its own sales channel.

In the three whip industrial chain, tongkuai continues to take another step forward and advance to laser components. 2019 is the most active year for tongkuai in this field. By setting foot in the fields of laser components and materials, such as optical fiber and ceramics, it presents an effort to build the whole laser industry chain: from laser processing equipment to lasers, and then to materials and components. This seems to be contrary to the international division of labor that has prevailed in the laser industry for many years.

Table 1 M & a layout of tongkuai in recent five years

(source: network collation @ Nanshan Lin Xueping)

Digitization is a new challenge that all old machine tool manufacturers must face, and so is tongkuai. With the help of industry 4.0, tongkuai tried to establish an industrial Internet platform axoom in 2015, but it ended in failure four years later. The axoom platform was sold, and industrial Internet technicians returned to tongkuai. But for tongkuai, the digital transformation is an unstoppable pace. It has been emphasizing the remote connection of machines. An Italian company rents 14 second-hand machine tools from tongkuai. It relies on this kind of remote monitoring and guidance to maximize the efficiency of the machine. Following the acquisition of an ERP company in 2018, tongkuai acquired a sheet metal software company this year, which means that it needs to get through from design and manufacturing, material management to design scheduling.

A good hand is flying: relevant

Coherent is an old laser company with a history of more than 50 years, but its development in the last 20 years is the most complicated. It can be said that coherence is technically in the right position every time, but it is still the attitude of an out player in the end.

In the first decade of the 21st century, through several mergers and acquisitions, relevant companies completed the in-depth layout of ultrafast lasers and excimer lasers. Excimer lasers have always occupied a monopoly position in the field of flexible OLED and photoelectric display.

In the second decade, the technology strategy is as sensitive as ever. In 2012, coherently acquired lumera company of the United States, which is the world's first industrialized ultrafast laser manufacturer. In the same year, innolight, which is also a picosecond laser manufacturer, was acquired, and the core technology was supplemented by the acquisition of midaz, a laser amplifier enterprise. According to the status of coherent leading laser, 2012 may become the first year of ultrafast laser in the industry. Following the acquisition of ultrafast laser raydiance in 2015, coherent acquired ondax, a grating ruler manufacturer, in 2018, forming a complete set of picosecond laser manufacturing capacity.

While expanding in the direction of micro machining, coherence is also expanding in the field of macro machining. In 2016, it acquired German rofin laser, which previously acquired nufern, an American special optical fiber manufacturer, to strengthen the production capacity of a full set of devices. Although the low-power carbon dioxide laser of rofin UK subsidiary was subsequently sold due to the monopoly restriction of the European Union, it still enabled relevant companies to obtain strong macro processing capabilities such as laser cutting and welding.

This is a landmark node in the laser industry, and the most promising laser company was born. This is the best time for related companies. In 2016, the related revenue was nearly $900 million. After the acquisition of rofin and the popularity of flexible screen cutting, the company's revenue almost doubled in fiscal 2017. In 2018, it reached a historical record of US $1.9 billion, surpassing Han Zu and IPG to become the second in global revenue, and ran to tongkuai's position as the leader of laser. In other words, if not the non laser business of tongkuai, relevant companies have become the leader of laser in the world.

Relevant companies have good first mover advantages and good customer reputation. Coherent lasers are often used for myopia scalpels. Coherence is an all-round laser player without technical short board. It has advantages from the laser to each upstream component, including pump laser, oscillator, amplifier, tunable OPA and its accessories. Through mergers and acquisitions, the company has diversified its business. The relevant company has the luxury combination ability of lasers, sensors and optical devices, but this does not make it go further. Even if the flat panel display is flying in China, coherence still fails to reverse its decline. It is really the unfortunate son of the laser industry. In fiscal year 2020, the related revenue was $1.2 billion, with an unprecedented large loss and a net profit of $400 million. The history of coherent development can be seen as a process of sudden collapse of things with excessive expansion. What is behind the top of Mount Tai? Not higher peaks, but deadly cliffs.

Relevant companies seem to lack a good stomach, which is unfavorable to the technological digestion of M & A. For a period of time after the acquisition, technology founders often run away, resulting in technology loss. Many people who left rofin acquired by it have now become the founders of Chinese laser brands. It seems that even if an enterprise has a stable M & a strategy, it may not be able to integrate in place and really obtain technology.

In 2021, the relevant enterprise life cycle has come to an end. At the moment when the curtain was about to fall when the two companies competed to buy it, it was swept away by another laser component company. Another dramatic M & a scene.

Reverse swallowing High Jumper: II-VI

Cheng Yaojin, who came out on the way to take over the relevant coherent, is the II-VI (Erlu) company. This strange name comes from groups II and VI of the periodic table. II-VI company can be regarded as a chemist's pocket, which is filled with various optical elements and materials, as well as laser lenses.

But if you imagine II-IV company as a chemist with glasses and white hair, you are obviously only half right. The ability of materials has always been closely combined with process manufacturing. For decades, II-VI has unique processing capabilities in zinc selenide material processing, film coating and precision diamond cutting.

It can be said that II-VI company has an accurate understanding of manufacturing.

In 2017, II-VI acquired Kaima wafer manufacturing to strengthen its manufacturing capacity in semiconductor devices. In terms of wafer manufacturing capacity in the United States, it is eclipsed by the brilliance of TSMC in the 5 nm or even 3 nm process. In fact, this is not the whole truth of semiconductor manufacturing. 5 nm process is just an application direction. In the manufacture of many sensors and semiconductor devices, it does not need such high support capacity. For example, MEMS sensors, such as the next generation of power electronics, the United States still has unparalleled manufacturing capacity. II-VI company acquired innovion company in 2020, which is the world's largest ion implantation service provider for the next generation of power electronics. The acquisition of manufacturing plants in this way is not an isolated action, because it also acquired ascatron, another company with a long history in silicon carbide, which can be used in various high-voltage power electronics. When China's wind and solar power enters the network on a large scale, power electronics suitable for flexible DC will become the key technology. And II-VI knows where its advantages come from. Materials are seen from the outside, but manufacturing is the foundation of II-VI. These two acquisitions in 2020 adopt the integration capability of silicon carbide with vertical integration, thus showing the thinking behind the II-VI M & a strategy.

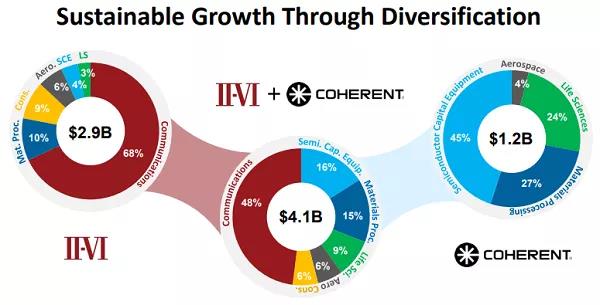

II-VI reached US $3.1 billion in fiscal year 2021, an increase of 30% over 2020. This time, it was replaced by II-VI to catch up with fast. If we consider that II-VI has only $1.2 billion in revenue in fiscal 2018, we can witness a company flying up the rocket.

II-VI is impressive and stems from its flexible localization attitude. In 2010, the first year of China's laser, II-VI entered the Chinese market by acquiring Gaoyi company. Gaoyi is also one of the achievements of academician Chen Chuangtian, the pioneer of Chinese crystal and even laser. In 2009, Fuzhou Fujing, founded by academician Chen's technology, was just listed, which undoubtedly posed pressure on the high intention of seeking listing at that time. With more than 3000 people and the intention of improving the facilities, the factory chose to be acquired by II-VI for us $82 million, which also doubled the number of employees of the latter. Gaoyi not only has technology, but also provides huge manufacturing capacity and open Chinese market. In return, II-VI did not lose the name of "Gaoyi". Until today, it still takes "II-VI Gaoyi" as the company name in China. Different from the relevant companies left behind after the merger and acquisition, the executives of II-VI Gaoyi company still maintain the lineup of Gaoyi in that year.

However, goodwill is not the consistent face of capitalists, greed is. Looking closely at the past, it can be said that Gaoyi's material business and crystal have brought stable income to II-VI. In the first year of laser, Gaoyi was acquired, which directly connected with the blood of Chinese academicians' top crystal technology. II-VI really found a good deal in China.

It is more clear that II-VI is "bold" in the M & a market, or it acquired Finisar, the leader of global optical devices in 2018. Finisar originally mainly produced optical modules supporting communication. With the rapid development of mobile Internet, big data centers are blooming all over the world, which has brought great business opportunities to Finisar. The purchase price was US $3.2 billion, while the annual income of II-VI was only US $1.2 billion at that time, which was not as high as Finisar's annual income of US $1.4 billion.

Climb high, you can climb high. Greedy II-VI is focused on this point. Before that, II-VI was mainly lasers and chemical materials. As the core discrete device supplier in the optical module, it can directly supply to Finisar. This once again confirms the amazing integration ability of II-VI. II-VI goes further and further in the direction of vertical integration. This acquisition makes II-VI enter the field of optical devices from optical materials, and directly enter the field of optical communication from the field of laser and optoelectronics. The consumer electronics and 5g markets are full of delicious food. 3D sensors (whether mature mobile phones or emerging smart Internet connected vehicles) and lidar will become a big meal in II-VI.

From January to March this year, it was a thrilling moment for II-VI experience. In January, lumentum, the second largest optical device in the world, announced the acquisition of coherent for us $5.7 billion. In February, another American instrument and laser manufacturer MKS announced a quotation of US $6.6 billion, and Cohen made a serious evaluation. At the same time, II-VI entered the game as the third suitor. In March, the wavering coherent showed a "boring" side, and finally fell to II-VI, priced at $6.5 billion.

This vacillation shows that coherent is not a firm productist, but a genuine opportunist. Perhaps this corporate character determines its ultimate fate. In the past two decades of rapid development of laser, coherence has seized the opportunity, but failed to seize the fate. This is a negative case that has technology, capital and layout, but has been ruined by management mistakes.

Figure 3 II-VI and coherent complementary

In this courtship, the most frustrated nature is the Millennium second lumentum of optical devices. It is not the first time it has been frustrated by II-VI. After acquiring the third Oclaro in 2018, it briefly surpassed the industry leader Finisar, but the latter quickly joined the II-VI group. However, the acquisition of Oclaro is still a good move, because the latter is also one of the optical device manufacturers with the most experience in M & A in history. Since its establishment, M & A has continued. In 2012, it acquired opnext, the 10th optical device manufacturer in the world. With turbulence, optical device manufacturers are stepping up integration. The loss of coherent also means that lumentum can only play the role of components in the field of industrial lasers. To be the leader of the second echelon of laser, it needs to wait for the next prey.

Chased IPG

In the laser industry, fiber lasers are worth a lot of money. It has established a prominent position in the laser processing industry. With the comparison of fiber lasers, people found that the previous carbon dioxide lasers were too slow to develop the market. The first IPG of fiber laser has natural power. There are two magic weapons for it to stand on the cusp of the storm. The first is the first mover advantage, which first opened the moonlight treasure box of fiber laser; The second is the active M & a strategy. In the past decade, it has completed 13 m & A.

IPG technology originated from the former Soviet Union. It was established in the same year of the disintegration of the Soviet Union to provide fiber lasers for industrial and medical industries. However, its orders came first from Europe and then the United States. After the current name IPG was officially named in the United States in 1998, it has become a real American company. After it opened the door of 100W fiber laser in 2000, a magnificent mountain began to appear in front of people. Fiber laser began to accelerate and take on the main responsibility of lasers with different principles. In the first year of China's laser, its annual sales were US $300 million, enlightening the Chinese market.

In China, IPG was once synonymous with fiber laser. However, this advantage was eroded by later Chinese laser manufacturers. Wuhan Ruike is the first competitor to challenge IPG. Ruike, the second listed laser company in 2020, has a revenue of RMB 1.6 billion and a profit of RMB 260 million. On a year-on-year basis, Huagong technology, which takes laser equipment as its main business and ranks second, has a revenue of 4.6 billion yuan, but a profit of only 350 million yuan. This fully shows the profit advantage of laser as the second echelon of laser. There is only one goal of Ruike, that is the IPG ahead.

In fact, in China, IPG has become the target that laser manufacturers catch up with verbally. The 10000 watt laser of IPG has just begun to popularize, and domestic laser manufacturers such as Chuangxin can't wait to warmly promote the "10000 watt era". Domestic laser manufacturers such as Ruike laser, jept, Feibo laser, Dake laser and caplin optoelectronics are all promoting together. Will this situation of 10000 watts make IPG feel cold?

From a certain point of view, 6kW medium power lasers basically meet 80% of the market, and 10000 watt lasers are probably better than the market. So what kind of layout is IPG, the global leader of fiber laser, still doing?

It is considering three aspects. The first is to enrich the product line. In 2012, it acquired jpsa of the United States to expand the field of micro machining. The latter's ultraviolet and excimer lasers are unique in the micro processing business of ceramics, glass and semiconductors. Optigrade, a grating company acquired in 2017, strengthens the integrity of the laser optical path system.

The second aspect is to actively promote downstream users and listen to the voice of end users. Generally speaking, laser manufacturers in the second echelon of the three whip structure of the laser industry do not care about which end users are using their products, which is solved by the first echelon laser equipment. IPG broke this rigid impression through two acquisitions in 2017-2018. First, it acquired the Canadian LDD company to carry out automatic detection of laser welded welds, which is really rare and considerate. In 2018, it acquired genesis, a robot automation welder, at a price of US $100 million, which has clearly entered the field of laser processing equipment. IPG's attitude towards laser welding has become clear.

The third aspect is the application of laser. In 2017, it acquired the American laser system IL, which specializes in locking the optical path system of medical devices; In 2019, it acquired padtec subsea network division in Brazil, provided optical line amplifiers (repeaters) and other components for subsea optical cables, and participated in the construction of next-generation data center and global subsea cable network.

If you look at the opposite, perhaps IPG is forced to enter the downstream market. It needs to open up new positions in revenue. Its troubles should also come from China's enthusiastic pursuers. After reaching US $1.45 billion in 2018, it decreased year after year; Revenue in 2020 is $1.2 billion. The biggest halberd market during this period was in China. In 2018, IPG China's revenue was $630 million, a year-on-year decrease of 22% in 2019. Of course, due to the ability of vertical integration, IPG has maintained a strong profitability, with a gross profit margin of more than 55%, which has only deteriorated in the past two years.

China is the world's largest market for IPG, surpassing the United States. The hot market competition situation of China's laser industry also makes IPG's M & a strategy have one more option: expand the market outside the fiber laser.

Unexpected face: MKS

Another company that made coherent look embarrassed was MKS. It also participated in the bidding for acquisition, but it ended in vain. Speaking, it is a manufacturer of semiconductor equipment and instruments, but it seems to like to tie it with laser.

It acquired spectral physics SP in 2016. As the earliest manufacturer of commercial lasers, spectral physics has the same long history as related companies. A company that has experienced the growth of lasers from infancy to peak, spectral physics company is simply the development history of lasers. It has the advantage of starting first in femtosecond laser. In the 1990s, the Ti sapphire femtosecond laser oscillator developed by spectral physics is still a sword.

To obtain such a laser living fossil, MKS paid a price of $1 billion. Rather than gain a laser company, MKS has almost pulled its history in the laser industry to a glorious starting line. Importantly, it establishes the position of MKS in the field of ultrashort pulse micromachining.

Two years later, MKS spent another $1 billion to acquire American ESI company. This time, it gains the micromachining ability of circuit board. In the microporous drilling equipment manufacturer, ESI has the advantage of being alone and competing with Mitsubishi of Japan. ESI also acquired the fiber laser of eolite in France in 2012, thus strengthening the micro processing capacity of circuit board. However, ESI is not only drilling, but also strong in wafer processing, such as scribing, grooving, marking and memory repair. Therefore, it is also an important supplier of global wafer factories, which is the market MKS wants to temper.

After the failure of acquiring coherent at the beginning of the year, MKS had no time to be sad. It spent $320 million in May to acquire Canada's photon control PC company. This optical fiber sensor company will strengthen MSK to grasp what happens in the mold cavity of semiconductor equipment - which is often a mysterious black box, so as to improve the yield of semiconductors. In a sense, this layout is preparing for the digitization and intellectualization of equipment. Considering that PC company has only $51 million in revenue, this premium is also quite high. All mergers and acquisitions prepared for digitization have to pay more.

In July, MKS made a non-stop bid to include ammett apotech, an American electroplating chemical company. Bid $5.1 billion. Considering the $6.6 billion bid at the beginning of the year, MKS is really arrogant. Does this money have to be spent?

It seems that this acquisition is insensitive to laser, but MKS is drawing a bigger circle. In this circle, the fields of laser, optics, motion and process chemistry permeate each other, so as to realize the interconnection of high-density circuit boards. This is the key manufacturing capability for the miniaturization and complexity of the next generation of advanced electronic products.

Not playing cards according to common sense, but also arrogant and willful, MKS company has defined a new benchmark for the laser industry.

Calm market: China

In China's M & a market, we will naturally look at the performance of the leader first. Han's laser purchased baublys control laser for us $7 million as early as 2012. However, this is only to obtain the right to use a brand, which is more like an effort to enter the American market. The factory of this enterprise was thrown back by the big family, which was like spitting out half of an apple after eating it. There is basically no inheritance of knowledge.

In November 2016, Han's laser acquired 80% equity of Canadian special optical fiber manufacturer coractive for RMB 170 million. The acquisition of special optical fibers is often an important measure for laser manufacturers. As early as 2007, Ennai nlight, a high-power semiconductor laser manufacturer in the United States, acquired liekki, a Finnish special optical fiber manufacturer, to integrate laser and optical fiber technology to achieve self-sufficiency of special optical fibers.

In March 2017, Ruike laser also announced the acquisition of 85% equity of Wuhan Ruixin optical fiber, a special optical fiber manufacturer. The actual controlling parties of the two enterprises are actually China Aerospace Sanjiang group, but it also allows Ruike laser to better integrate the special optical fiber integration capability.

It's like an addictive game. In 2020, jept optoelectronics, a laser manufacturer, announced its shareholding in Changjin laser, a special optical fiber manufacturer. Of course, the scale is very small, only a mere 10 million yuan.

In 2017, Han's laser acquired Jinfan Zhanyu new energy, which seems to be going into the field of power battery welding. Han nationality has enough interest in making special aircraft equipment for deeper industries. But here, it is also easy to be blocked by professional automation equipment integrators, and it is not easy to move forward.

The acquisition of Han's laser is also easy to cause criticism. Because Han laser seems to be more interested in buying real estate. In November 2018, Han's laser acquired muti-well for more than 400 million yuan. This strange sounding name is actually a piece of land. Since 2011, it has set up a Han family European company in Europe, with an investment of 700 million, which is known as the R & D center, but it turned out to be just an old Swiss Castle Hotel. This makes it also questioned in the capital market.

M & A can easily form business diversification. For example, guangyunda, as a precision laser comprehensive application provider, has not found a good breakthrough since it was listed for ten years. Several mergers and acquisitions are trying to seek new breakthroughs. At present, the acquisition of Chengdu Tongyu Aviation Equipment Manufacturing Co., Ltd. in 2019 at a cost of 200 million has finally opened a hole. Through additive manufacturing, guangyunda entered the additive manufacturing in the aerospace field and tasted the sweetness. In June 2020, guangyunda purchased all the shares of Tongyu for 245 million yuan again. The return is good. At present, Tongyu's orders from airlines are very sufficient, reaching 64 million yuan in the first half of the year, accounting for nearly 20%. M & A finally opened a situation for guangyunda.

Precise acquisition will bring greater competitiveness. In August 2016, Xi'an Juguang, which specializes in high-power semiconductor lasers, spent RMB 220 million to acquire limo, a German micro optics business, and completed the layout of optical fiber coupling devices. In 2019, Zhuhai optical library technology acquired relevant assets of lumentum high-speed modulator product line, including chip and device production equipment, with us $17 million.

M & A will form a diversified business, and it also brings a benefit of talent spillover. In 2007, when German rofin acquired nufern, the world's largest manufacturer of special optical fiber and laser modules, a key figure was released. The most important technical seed of Ruike laser is a senior researcher from nufern.

Ruike's breakthrough in fiber laser has directly driven the rapid development of China's laser industry. In 2019, it acquired the controlling interest of Guoshen optoelectronics at the price of 110 million, which marks that Ruike laser has officially entered the ultrafast laser market and started to make efforts in the fields of LED chips and glass cutting.

M & A has brought a new strategic intention to enterprises.

Note: the light will not stop

Light is considered the friendliest messenger in the world. All places with gaps will be filled automatically. This is a metaphor for the development of the laser industry. Before the first year of China's laser in 2010, the manufacturing industry did not leave too many opportunities for laser. But the laser is tenacious. It crowded from all directions and kept looking for its own territory. It has gained a firm foothold and created a golden decade of laser development, which also proves that laser is a technology that can be deeply valued and trusted. However, light is also unpredictable. It has enough energy to create subversion at any time. In order to grasp the direction of the light path, M & A is still the best choice for entrepreneurs. In the next decade, the laser industry will be more promising, and the M & a strategy map will still be the golden compass.

Copyright © Shenzhen Kinghelm Electronics Co., Ltd. all rights reservedYue ICP Bei No. 17113853