-

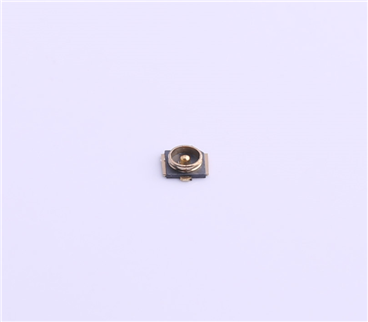

- RF Series

- Connector&plug-in unit

- Plug-in unit

- SD card holder

- SIM card holder

- Thimble /wire protector

- Crimping terminal

- Waterproof joint

- 短路帽/跳线帽

- 压线端子胶壳

- 屏蔽夹

- Waterproof and dustproof terminal

- Industrial&automotive&military

发布时间:2021-12-31作者来源:金航标浏览:2355

Let's start with an episode. Citibank revealed that Apple slashed the target price of supplier skyworks by 27%; For the sake of orders and profits, did Apple force the top chip suppliers so much? No wonder imagination and dialogic cry and beg China to hug. But think about it, how can the supply chain survive when leading enterprises reduce production? Foxconn may have insomnia all night!

Semiconductor rankings mask the downturn pit left by rising prices (storage, CIS and MOS)

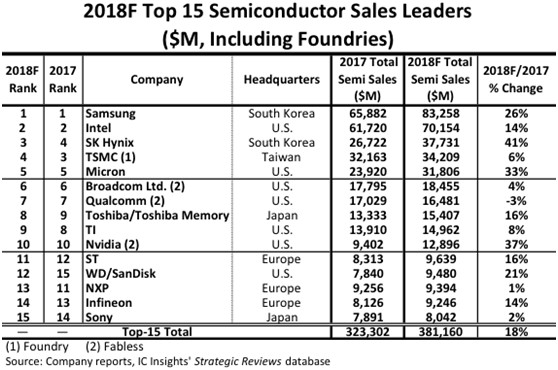

On November 12, 2018, IC insights released its latest report and announced the forecast ranking of the world's top 15 semiconductor enterprises in 2018. Of course, no mainland chip companies are on the list as usual.

What do you think of these storage giants? How do they look like Chinese real estate tycoons! Am I thinking too much?

As can be seen from the above table, the winners in the semiconductor industry are basically concentrated in the field of main control chips such as storage, CPU and GPU.The cruel truth is that if the price increases of memory chips and camera chips are put aside, the growth of the global semiconductor industry is likely to be negative in 2018.

So the Philadelphia Semiconductor Index is the real barometer of the chip industry.

Philadelphia Semiconductor Index fell rarely

In six months, it dropped from nearly 1400 points to 1174 points, a decrease of more than 15%, which is extremely rare. In the same period last year, it exceeded 1350 points. These index stocks of the semiconductor industry chain are really a leaf of knowledge.

Intel is also a torment. The latest CPU can't be called out, and the old model can't keep up with the supply, which makes a lot of follow-up chip manufacturers unable to sell. In the final analysis, this is the disaster caused by Moore's law forcing consumers to pay.10 nm or 7 nm, where do ordinary people know?

Headache inventory

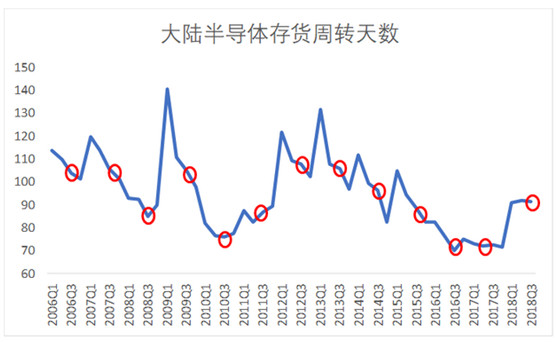

According to the Research Report of Guojun electronics, the inventory turnover days of mainland semiconductors reached 92 days in 2018q3, which was basically the same as that in 18q2. In history, the third quarter was the relative low point of inventory turnover days in the year (the red circle in the figure below shows the third quarter of the calendar year, which was at the low point in the year and decreased month on month compared with the second quarter), indicating that mainland semiconductors also had inventory pressure in the third quarter.

fromFrom the perspective of changes in downstream applications of global analog chips, the overall demand is declining. There is no obvious excitement in consumer, automobile and industry, which is the reality of the supply chain. On the contrary, chips can't be sold. Where's the spark from the manufacturing industry?

The price and demand of memory chips can't hold up

According to the survey of Jibang consulting semiconductor research center, the NAND flash market will be oversupplied in 2018. As the OEM inventory of notebook computers and smart phones has been fully prepared, coupled with the impact of Sino US trade friction and Intel CPU shortage, it can be said that the demand momentum is even worse. Therefore, in October, in addition to the continuous decline in SSD and EMMC / UFS prices, the contract prices of various NAND flash particles and wafer products decreased more significantly.

It is expected that the momentum of goods preparation after mid November will be flat. In October, the contract price of TLC NAND flash wafer fell by 13-17%, which was the largest monthly decline since the wafer price began to fall in November 2017. Although the peak sales season in Europe and the United States is approaching at the end of the year, this wave of price decline has failed to effectively stimulate the stock momentum of module factories. Therefore, it is expected that the price decline in November and December will be difficult to stop.

Roller coaster with passive components

Recently, downstream operators reported that Guoju Suzhou plant has reduced production of passive components due to weak terminal demand and large inventory in the hands of OEM and channel operators. At present, the production capacity of Suzhou plant is only 50%, and it is expected to further decline to 30 ~ 40% in December. Guoju does not confirm the reduction of production in Suzhou factory. From the shortage of passive components to the frequent disconnection of OEM, to the reduction of giant Suzhou factory in the market, it is only half a year away.

And Guoju's stock is a bloody roller coaster; From 1310 yuan high platform diving to today's change of 311 yuan, what you play is not only the heartbeat, but also the courage to climb up the roof.

It is worth noting that the distributors who purchased goods from Taiwan's passive component industry dominated by Guoju in July and August successively entered the payment period after September. However, in recent months, the price of passive components has fallen sharply, and many distributors who have full inventory have been unwilling to pay the previous high price since November, and even delayed to change and asked to pay at the current price, The subsequent impact remains to be observed.

Many agents said that the price of MLCC products has been reduced across the board, and individual price reductions have reached 40% - 60%. Huaqiangbei, where the MLCC spot market is relatively concentrated, has started to ship goods, and even the spot price of high capacity MLCC has fallen by 10% - 15%. The considerable wealth accumulated by some passive component distributors in the early stage may face the result of floating or even losing everything.

The above analysis is based on the end of the supply chain, and the following description based on mobile phones, cars and the Internet of things is the sunset of the electronic manufacturing industry.

Smartphone Production fell (Apple), and OEM reduced production and orders

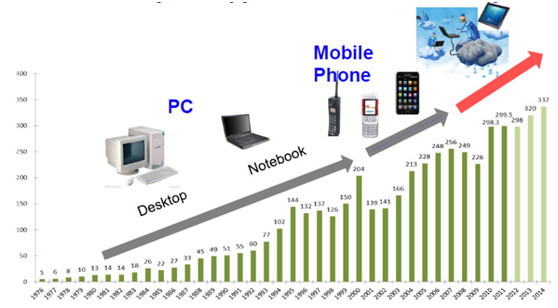

The golden age of semiconductor in the past decade is a golden decade driven by smart phones led by iPhone. Now even apples can't be carried away!

According to IDC, a market research firm, global smartphone sales will decline slightly by 0.2% year-on-year in 2018, and then return to a slow annual growth rate of about 3% from 2019 to 2022. According to the official website of China Academy of communications and communications, from January to October 2018, the shipment of 4G mobile phones was 324 million, a year-on-year decrease of 15%.

TF international securities, a well-known Apple analyst, lowered its forecast for iPhone XR shipments, saying that between the fourth quarter of 2018 and the third quarter of 2019, the forecast for iPhone XR shipments will be reduced from 100 million to 70 million. Apple's share price fell 5% on the 12th, and its market value evaporated $48.9 billion a day.

Japan's economic news reported earlier this month that Apple had informed Foxconn and Heshuo, two contract manufacturers, to suspend plans to add an iPhone XR production line. Overall, the order volume of iPhone XR and iPhone XS Max was reduced by 20% to 30%. Longbow research, an investment bank, said in a research report on Monday that there was a risk of falling demand for iPhone in the Chinese market.

It seems that except Huawei and ov, the G-spot of other mobile phones has disappeared.

Cold winter of automobile industry

Previously, the sales volume of China's auto market rose all the way, and the negative growth of the auto market this year is almost a foregone conclusion. According to the latest statistics of the all China passenger Federation, in October, the retail sales of passenger cars decreased by 13.2% year-on-year. The overall market is not optimistic. Major car companies are affected to varying degrees. Even SAIC Group, which ranks first in sales, is difficult to survive, with a year-on-year decrease of 8.4%.

First financial analysis believes that at present, nearly 70% of the net profits of listed auto enterprises have declined. Even SAIC Group and GAC group, whose performance achieved year-on-year growth, their growth rate in the third quarter was significantly slower than that in the first half of the year. From the licensing data, in fact, the number of licensing of many manufacturers has increased negatively in March. Since June, there has been a large-scale decline in the data reported by automobile enterprises, and by September, the range and scope of the decline have further expanded.

From January to October this year, 879000 and 860000 new energy vehicles were produced and sold in China, an increase of 69.95% and 75.59% respectively over the same period last year. However, compared with the overall market scale of 29 million vehicles in China, the supply chain that can be affected is almost a drop in the bucket.Moreover, new energy vehicles, which account for only 3% of the total production and sales, are scattered in more than 200 automobile enterprises, which shows how serious the disorderly competition in the industry is.

The bubble of the Internet of things

According to the mobile Internet of things (2017) industry research report released by the research group of the school of management of Fudan University, the overall market scale of China's mobile Internet of things business will reach 1.76 trillion yuan in 2020, and the average annual compound growth rate of the market will reach 15%.

However, in practical application, limited by the technical bottleneck, many Internet of things applications are actually covered with a layer of shell, icing on the cake, and the real demand is not so strong. At present, the sales of Internet of things products (smart hardware, smart home, etc.) on the market are not optimistic, while enterprise level Internet of things projects have large investment and long cycle, and it is difficult to contribute much value for a while.

In other words, at the chip level, there are only some more sensors or communication modules. Other, the bottom layer and operating system are the back garden of giants, and there are no innovators. How many of the Internet of things industrial parks blooming all over the country have died down and how many are still surviving? How many traditional industries have been hit by the trillion scale and repeated calculation on the Internet?

Therefore, we see that there is no real giant in the field of Internet of things. Therefore, people can't wait to hype the next hot spot - AI Artificial Intelligence.

Giants such as Japan, the United States and South Korea laid off workers and fled Southeast Asia

Bern optics Huizhou factory, a giant touch panel supplier in Apple's supply chain, recently announced that it would cut 5000 dispatched workers. Flextronics, a world top 500 enterprise and well-known foundry, and its subsidiary Flextronics Plastic Technology (Shenzhen) Co., Ltd. are affected by the external environment. The company plans to arrange some employees for holidays in the following six batches from November 12, 2018 to February 1, 2019.

At the financial report meeting on November 8, 2018, Heshuo, a large apple assembly plant, disclosed that it was planning to withdraw the production line from the mainland to Taiwan or transfer it to Southeast Asia for production, so as to avoid the impact of the Sino US trade war. In addition, Taiwan factories Renbao, Weichuang, Taijun, Meilu and Kecheng, which are also Apple's supply chain, also have plans to withdraw their production lines from the mainland.

Now there is another manufacturer with such an idea. Yingyeda admitted on the 12th that the company began to prepare for the impact of the trade war a few months ago. The first wave has little impact, and the second wave is afraid to be affected. At present, it is planned that the SMT production process will stay in Shanghai. As for the later stage assembly, due to the relatively large demand for manpower, notebook computer products will be assembled in Mexico, The smart device is assembled by Penang factory in Malaysia.

Before that, Japan's Suzuki group announced its withdrawal from China, Omron and Seagate's factories in Suzhou also announced their closure, and Chuanjing motor, Daikin industry, Panasonic electric appliance and Japanese power products also moved out of China one after another.According to incomplete statistics, nearly 430 Japanese enterprises on the mainland have evacuated from China, and countless South Korean and American enterprises have evacuated.

The Nikkei research company recently surveyed 240 managers of 428 large and medium-sized non-financial companies and found that since May, only 3% of Japanese enterprises are worried about the impact of their exports in the mainland and the slowdown of mainland demand. Now as high as one-third of Japanese enterprises are worried, and another 53% of Japanese enterprises are worried about the impact of Sino US trade disputes.

Collapsing stock market

Water overflows when it is full. In 2017, the Philadelphia Semiconductor Index rose as high as 48.62%, a record high. Chunjiang water heating duck prophet, let's take a look at the stock markets in Europe and the United States. Since October, these well-known chip stocks have gradually dropped rapidly from high levels.

European and American stock markets fell. Although the performance hit new highs again and again, the share price of chip leader Samsung Electronics gradually fell from a high level. Samsung issued a rare warning and expected that due to the "seasonal weakness" of the chip market, the overall profit may decline in the fourth quarter. Samsung also announced that its capital expenditure will drop to 31.8 trillion won in 2018, down 26.7% from 2017.

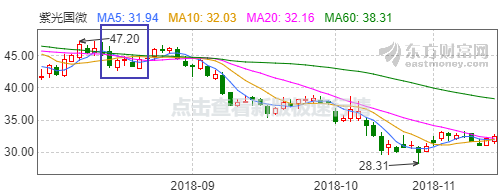

In China, chip is the core industry strongly supported by the state. Although most chip listed companies have received different efforts from large funds and other investment institutions, generally speaking, the stock trend is still relatively miserable.

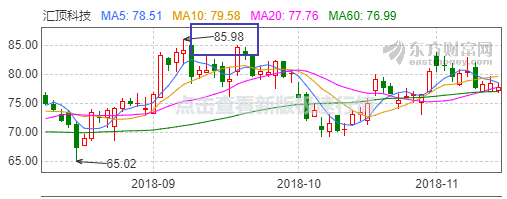

From the perspective of several chip companies with the largest local market value, they are showing a downward trend. Huiding technology fell reasonably because of the outbreak of the market for off-screen fingerprint chips.

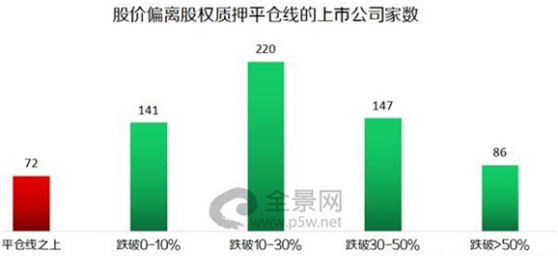

According to the calculation of Tianfeng securities, as of October 9, 2018, the share prices of 840 listed companies in normal trading were close to the early warning line of equity pledge, of which,The number of listed companies falling below the warning line has reached 780, a record high.

The stock market, foreign exchange market and real estate market are bleak, and the financing and loan channels for enterprises are becoming narrower and narrower. Seeing the water level of the reservoir decline, they can't fish with all their strength. From top to bottom, how can they save themselves?

The myth of invincibility in China's market is broken

In October, the PMI of China's Manufacturing Purchasing Managers Index was 50.4%, which continued to fall, indicating that the future economic growth will continue to decline. In the third quarter, the growth rate of exports and investment decreased, and the shortage of enterprise funds became increasingly prominent. Affected by it, the overall economic growth showed a downward trend.

In the future, the growth rate of export and investment is expected to continue to decline, and the destocking activities of enterprises will increase. Affected by demand factors, it is expected that the future economic growth will continue to decline gently.

According to the latest data released by the Ministry of industry and information technology, in the first three quarters, the growth of main business income of electronic information manufacturing industry above designated size is decreasing month by month, the main business income is decreasing by 4.3% compared with last year, and the total profit is decreasing by 15.3% compared with last year. In the first three quarters, the producer ex factory price of electronic information manufacturing industry decreased by 1.9% year-on-year.

The decline in exports and investment, the decline in demand and the decline in growth rate indicate that China's electronic manufacturing industry is at its peak and entering an unprecedented winter?

Without a new growth pole, will 5g be a life-saving straw?

Stars light up and break through the sky. There is no new industry to stand up and tell stories. Who will be the last savior? 5G?

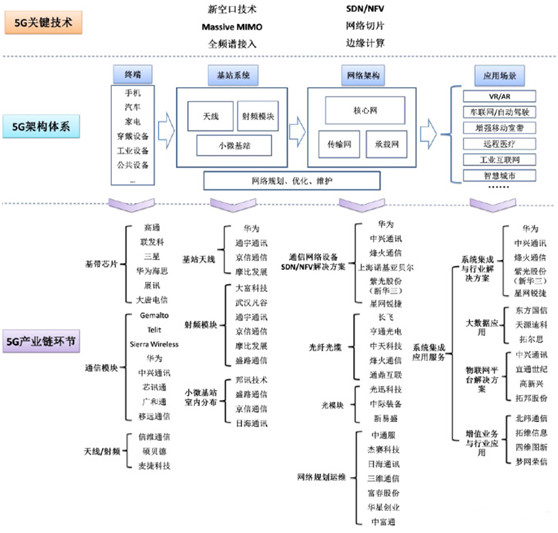

It is understood that China's 5g spectrum will be announced in the near future, and with the finalization of the spectrum scheme, the 5g license will also be released at the end of this year or early next year. According to the spectrum report released by GSA in July 2018, although few countries have officially issued 5g licenses, at least 89 5g related spectrum auctions are planned during the year. From the perspective of global deployment rhythm, the United States has made efforts on high-frequency millimeter wave and has been commercially available since the end of 2018. From 2019, Britain, Germany, South Korea, Japan and Australia will also realize 5g commercially on C-band.

From the situation in China, at present, the three major domestic operators have announced the 5g pilot city plan, and terminal manufacturers are also "rushing to the gate" to compete for the first wave of dividends of 5g mobile phones. Qualcomm said that at present, there are at least 18 operators in the world who jointly plan the early deployment of 5g with Qualcomm, and more than 20 OEMs will adopt Qualcomm's 5g solutions. Vivo, oppo, Xiaomi and other mobile phone manufacturers previously said they would launch 5g pre commercial mobile phones in 2019.

Huawei has launched a full set of 5g commercial network solutions based on non independent Networking (NSA) on September 30, 2018, and plans to launch 5g commercial system based on independent Networking (SA) on March 30, 2019. In addition to the schedule of 5g network products, Huawei will launch a 5g supporting Kirin chip in 2019 and a 5g supporting smartphone in June 2019.

2019 is likely to usher in the real 5g first year. The global 5g application fields will mainly focus on the Internet of vehicles, public safety, smart city, media and information entertainment. With the large-scale deployment of 5g applications, trillions of business opportunities will be brought to the industrial chain in the next 3 to 5 years. It is predicted that the direct output and indirect output driven by 5g will reach 6.3 trillion yuan and 10.6 trillion yuan respectively in 2030.

However, authoritative experts believe that the construction cycle of 5g is relatively long. In the early stage, it can only cover traffic and hot cities. It will take at least 5 years for all to be completed, and the application of 5g also needs to be postponed; During this period, 4G will continue to exist.

It seems that although 5g cake is very big, it also needs 9 lives to continue!

Copyright © Shenzhen Kinghelm Electronics Co., Ltd. all rights reservedYue ICP Bei No. 17113853