-

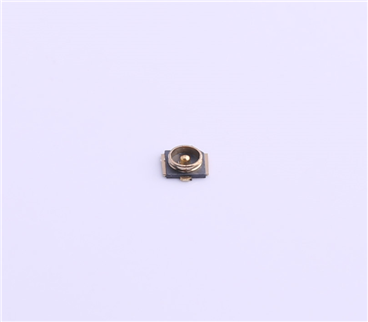

- RF Series

- Connector&plug-in unit

- Plug-in unit

- SD card holder

- SIM card holder

- Thimble /wire protector

- Crimping terminal

- Waterproof joint

- 短路帽/跳线帽

- 压线端子胶壳

- 屏蔽夹

- Waterproof and dustproof terminal

- Industrial&automotive&military

发布时间:2021-12-31作者来源:金航标浏览:2973

10 years without price increase, 10 years of price increase. Have you ever seen such a wayward component business?

The old Three Kingdoms giant forced the global leader Murata to raise prices. Did it rely on detached strength or resolute courage?

Make enough money for 10 years in one year

For passive component enterprises, in 1998, 2008 and 2018, mobile phones, smart phones, mining machines and three epoch-making "golden machines" ushered in a cycle and reached a climax in 10 years.

This time, it was more crazy, more violent and more demonic,One year is enough to make money for 10 years. Are you cruel?

So,The remaining nine years, is it fun? Or plan ahead? Is it a long-term fishing for big fish, or overdraft the future now?

For Chen Taiming, chairman of Guoju, business is just an episode of life. People who see the essence in a second are not the same fate as those who can't see life for half a lifetime. therefore,He chose the most desirable way of life for men - hunting!

A unique Hunter

The first important thing Chen Taiming did was to promote the listing of Guoju in 1993. With this sharp tool of capital, he was like a duck to water. First, he took advantage of the industry downturn to "pull down" the market value, and then took the opportunity to absorb it. Then, taking advantage of the schedule before and after the climax of the industry, write cheques and buy peers,Zhibao, qilixin, Philips passive components department, wangquan, Xianghua technology, Camry, meilei, Jiabang, Junyao, American pulse, etc. have been included in their shopping carts and become a member of Guoju group.

Secondly, Chen Taiming likes red wine. It is said that he has a habit of taking part in the company and friends' dinner. His men will take his favorite red wine to go. They will wake up in advance and wait until the most suitable temperature is reached before they are allowed to open the dinner. Once the best tasting time is exceeded, he will no longer take a sip of this bottle of red wine.

Chen Taiming also likes collecting,The bronze sculpture river was bought for $8 million, and the Scottish painter Peter doeig's oil painting flooded was photographed for $26 million.He has also successively collected the works of Gerhard Richter, mark Roscoe and Francis Bacon, making him one of the leading western contemporary art collectors in Asia.

Of course, Chen Taiming's favorite is the big beauty. His affair with Guan Zhilin is well known all over the world. Taiwan's China Times reported on his marriage to Guan Zhilin. As a result, it was sued by Guoju group and forced to publish a letter of apology in the newspaper. But Guan Zhilin later came forward and explained that she had settled the contacts between the two people.

Forced Murata to raise prices

On March 2, 2018, Murata, the boss of passive components, sent a notice to the customer. Since the production capacity could not meet the customer's demand, the price of mlcc0603 / 0805 products with high dielectric constant electrostatic capacity less than 1uF will be increased from now on.

You know, Murata's enterprise values have leadership temperament and high cold cleanliness. If you want to raise prices, you can't be persuaded by others. But this time, Murata was deeply frustrated by being kidnapped!

The boss doesn't raise the price, and the second and third try their best to raise the price. It's a little unreasonable in any way. But,Guoju has controlled the industrial situation and price discourse. How can it be handed over easily?By releasing the capacity crisis, Murata and others are overwhelmed; Through call auction, the price of components soared all the way.

Big stick and Huairou policy,Under the encirclement and efforts of many parties, the eldest Murata was forced to submit and issued a price increase notice to cooperate with the huge price increase wave of the national giant and the frustration and helplessness of the Japanese leaders, which must be mixed.At that time, Chen Taiming, however, was leisurely and contented. He rode the dust, completely ignoring the loud protests of huaxinke and other Taiwan colleagues.

All these willful, no strength and feelings, no courage to pierce the sky, why shengxiao silence? Why make trouble in heaven?

Soaring stocks

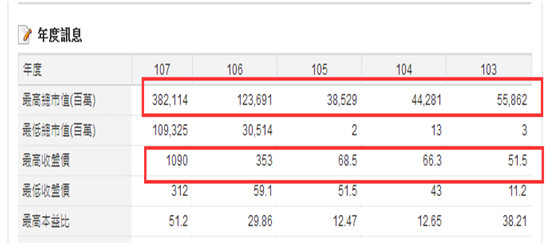

Back to the basic disk, let's first look at a set of data, how Guoju made Murata sign the alliance under the city. These data are enough to support the amazing performance of Chen Taiming and his giant Empire:

In the past two years, the stock of Chinese opera has increased by 18.63 times,The electronics industry chain peers, but only a little up. Throughout the world, no listed component company is so prosperous and soaring.

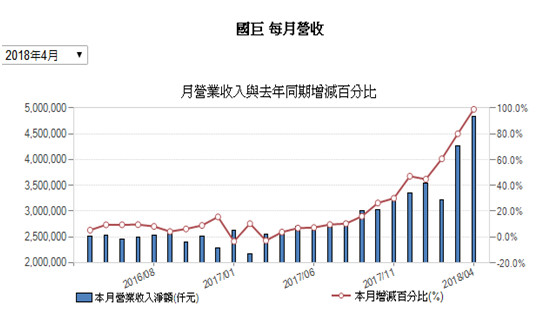

Let's take a look at the giant's take-off posture in the past year. It can be used"Unbridled“To describe, as if, the sky is its limit:

What we can see is that since this year, Murata's stock has also fallen by more than 10% due to transformation and upgrading. In 2018, after Murata announced the price rise, the overall stock price has increased by 15%.

You have to say that this is the normal performance of the two enterprises. It is estimated that no one will believe it.

Different market value management

Let's look at the market value growth process of Guoju:

Over the past five years, it has risen rapidly from NT $5.586 billion to 382.114 billion, about 82.2 billion yuan.The market value has increased nearly 70 times in the past five years, which can be called the first demon stock of global components. The unprecedented myth of making wealth, even Buffett, should be willing to bow to the disadvantage!

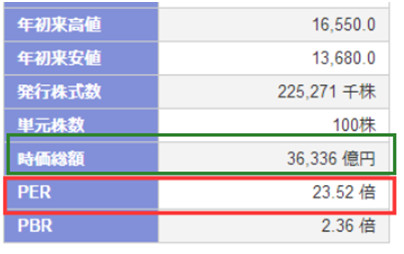

What about the market value of the eldest Murata?

As of March 2018, Murata's total market value was 36336 trillion yen, equivalent to about 212.9 billion yuan. In contrast,The market value of Guoju took the elevator and quietly climbed to the 40% level of Laoda Murata.

Well, my day!Murata group's efforts for more than half of its life for decades were hugged by the national giant overnight.Is this the victory of Guoju or Murata's rigidity? Is this the blessing of passive components or the sadness after wiping off?

Sales and profit

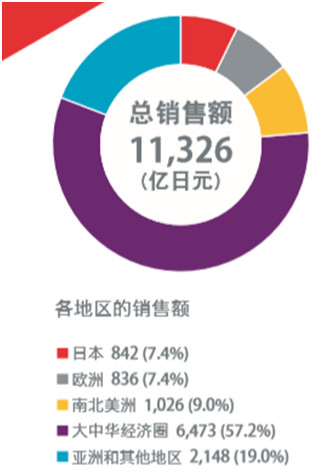

Murata's sales in 2017 were 1132.6 billion yen,About 66.4 billion yuan, with a gross profit of about 2012 billion yen, a gross profit margin of about 17.7%, a net profit of 156.1 billion yen and a net profit margin of 13.75%. Among them, sales in China and Taiwan accounted for 57.2%.

In 2017, the total revenue of Guoju was about 7 billion yuan, a new high, but only 10.5% of that of Murata. The gross profit margin is 32.54%. The net interest rate is 20.71%. The two values are much higher than Murata.

By 2018, the performance of Guoju continued to soar rapidly,According to the latest profit report in April, its gross profit margin reached 51.4% and net profit margin reached 38.82%. The two values simply dumped several streets in Murata. It is no inferior to Taiwan's semiconductor leader, TSMC.

Let's continue to look at the performance of Guoju in the past two years. It hovered before 2017, climbed steadily from the second half of 2017, and started the rocket speed in 2018.

In those days, as the MediaTek of the popular fried chicken, where had you ever looked down at the giant?Now, the status of the two has been turned upside down, with one star shining and the other eclipsed. Is this the spring and autumn version of sleeping on firewood and tasting gall?

Episode

Recently, China's antitrust authorities launched an antitrust investigation on the three memory chip giants Samsung, Hynix and micron. If the monopoly is established, the fine can be up to US $8 billion.Since Q3 entered the price increase channel in 2016, the price increase of memory chips has continued for nearly two years.

In 2017, China was forced to raise the price in the field of memory chips, and the overpayment was about 88.921 (2017) - 637.14 (2016) = US $25.207 billion.Under the huge changes, at the end of 2017 and May 31, 2018, the antitrust authorities had interviewed Samsung and micron respectively on the issue of continuous price rise.

Guoju, which set off a "bloody storm" and a big stick of M & A in the passive component market, initiated a call auction in the industry to let channel operators face the Guoju of customers. The stock price rushed to the Guoju of 1090 yuan, and the market value of Guoju increased 18 times in two years. Should we be more careful?

facts on file

PAUMANOK, a Market Research Institute, predicts that the global demand for passive components (capacitors and resistors) terminal industry will continue to grow rapidly, and will increase by 22% to US $28.6 billion by 2020 compared with 2017. The world's major MLCC suppliers include Murata, TDK, sun induced power, Kyocera, Guoju, huaxinke, Fenghua high tech, etc.

In an interview after the shareholders' meeting on June 5, Chen Taiming said that the Japanese factory has about 2500 MLCC material numbers. No new orders will be received in March next year. These products account for about 30% of the Japanese factory's production capacity and will spill over to Taiwan factory. At present, Guoju's orders are still greater than the production capacity, and it is in the state of distribution. The supply is in short supply, and there is still no solution until 2019.

Copyright © Shenzhen Kinghelm Electronics Co., Ltd. all rights reservedYue ICP Bei No. 17113853