-

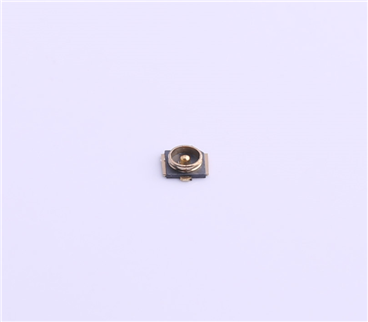

- RF Series

- Connector&plug-in unit

- Plug-in unit

- SD card holder

- SIM card holder

- Thimble /wire protector

- Crimping terminal

- Waterproof joint

- 短路帽/跳线帽

- 压线端子胶壳

- 屏蔽夹

- Waterproof and dustproof terminal

- Industrial&automotive&military

发布时间:2021-12-31作者来源:金航标浏览:3032

two thousand and sixteenIn March 2003, it was listed on the new third board; In March 2017, the listing on the new third board was terminated! This company with the largest revenue of wireless communication module in China is in such a hurry for IPO?

What you may not know is that well-known chip manufacturers such as silijie, Quanzhi technology, Qualcomm and Spreadtrum communications are its indirect shareholders.

Core smart and mobile are inextricably linked, so that mobile communication is shrouded in the light and fog of "Prince"!

Mobile communication

On July 13, 2018, mobile communication submitted a prospectus to the CSRC and planned to log on to the Shanghai Stock Exchange,The raised fund is 509 million yuanIt is used for communication module platform construction projects and technical support center construction projects, and supplement working capital.

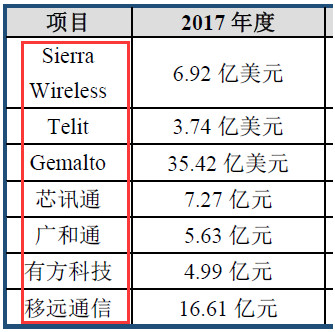

two thousand and seventeenIn, mobile communication realized an operating revenue of 1.661 billion yuan and a net profit of 86.3765 million yuan.

competitor

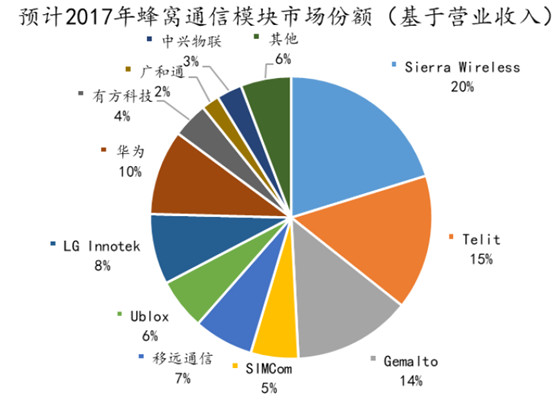

In the global cellular communication module market,The main module suppliers include mobile communication, telit, Sierra wireless, Gemalto, u-blox, smart core, guanghetong, Youfang technology, etc. In addition, ZTE IOT and Huawei are also strong rivals.

Component supplier

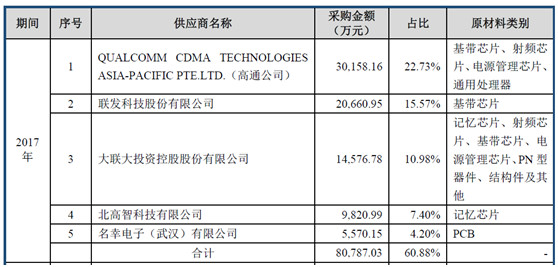

Through independent procurement, Huayuan purchases raw materials such as baseband chips, RF chips, memory chips and PCB boards from suppliers.

Chips are mainly purchasedQualcomm, MediaTekRelated products, PCB boards are mainly purchased from Xinli electronics. Raw materials imported from overseas are purchased by purchasing suppliersHua FuyangAnd other supply chain companies, and domestic raw materials are purchased through direct suppliers.

In addition to Qualcomm and MediaTek,The United Nations General Assembly, beigaozhi, Mingxing electronics and other agents occupied the top three。 In 2017, the total supply of components exceeded 800 million yuan.

After September 2013, the company gradually began to independently purchase raw materials and entrust themXintai communication, Jiashida and FlextronicsAnd other manufacturers for OEM production.

Sales model

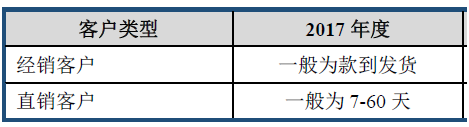

The company mainly adopts two sales modes: direct sales and distribution,By 2017, the company had 209 agents, accounting for 56.27% of sales to agents respectively. The company's direct sales to customers accounted for 43.73%, the proportion of sales amount of direct selling mode is rising.

Shanghai YiyuanThe five major agents are Shenzhen Dingxin Co., Ltd., Shenzhen shixunjie, Shenzhen Haitong, anfuli and Fuzhou ruilain technology. In 2017, the total sales of these five agents exceeded 420 million yuan.

The prince is inextricably linked

It also focuses on the field of wireless communication. The name of mobile communication is not only similar, but also inextricably linked with mobile communication launched in January 2017. It is reported that four board members and five senior managers of mobile communication, including the actual controllers Qian penghe, Zhang Dong and Huang Zhonglin, have served in mobile communication, and some have also worked in core smart.

You know,Wang Xi, the former shareholder of core smart, is the son of Yang Wenying, the richest woman in Shanghai. He is the prince with lofty aspirations. It has also been said that the initial investor of Yiyuan is inextricably linked with him. This layer of fog and light makes Yiyuan seem particularly mysterious and noble.

According to the prospectus, Qian penghe and Liao ronghua, the actual controller of mobile communication, jointly founded mobile communication company. Later, Qian penghe withdrew from the equity structure due to inconsistent business philosophy. Qian penghe founded mobile communication in 2010.

On March 9, 2015, Qian penghe and Dai Xiangan signed the equity transfer agreement, which agreed that Dai would transfer all of his 42.5% equity of the company at a price of RMB 21067300 to Qian penghe. Dai Xiangan is the mother-in-law of Liao ronghua, a former partner and now chairman of communications. The prospectus explained that Dai Xiangan's previous stake in Yiyuan company actually provided financial support for Liao ronghua's entrepreneurship of Qian penghe. In order to solve the problem of horizontal competition, Dai Xiangan transferred all his shares.

Gross profit margin

Since 2015, the net profit level of mobile communication has been greatly improved. In fact, since this year, mobile communication has directly purchased from chip suppliers such as Qualcomm and MediaTek.

In addition to having an impact on cash flow, Qualcomm even limits what kind of customers mobile communications chooses. Prospectus information display,Qualcomm will collect a deposit from China mobile communications according to the purchase scale (referred to as "purchase rebate" in the prospectus). The rebate can only be received after the company sells its products to customers meeting Qualcomm's requirements.

As a shareholder, Qualcomm is still so harsh against customers. Is it because of Huawei's relationship?

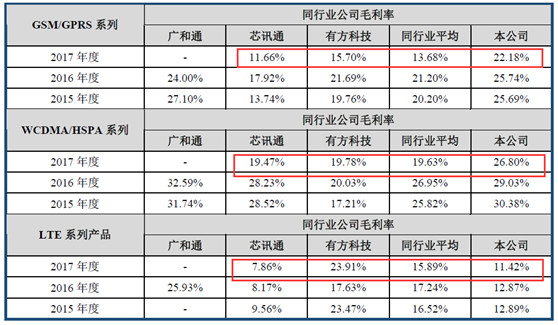

Similar to the IPO of Jingfeng Mingyuan, the gross profit margin of mobile communication shows a downward trend year by year. From 2015 to 2017, they were 25.42%, 23.05% and 18.02% respectively.

The suppliers of mobile telecommunication are relatively centralized. Among them, the purchase of Qualcomm accounted for 22.73%; The procurement volume of UNDC accounted for 15.57%. The total purchase amount of the two companies accounted for 38.3%.

Industry profile

According to the information disclosed by the Ministry of industry and information technology, it is expected that by 2020, China's internationally competitive Internet of things industrial system will be basically formed, including perceptual manufacturing, network transmission and intelligent information servicesThe overall industrial scale exceeded 1.5 trillion yuan, with a compound annual growth rate of 27.48%.

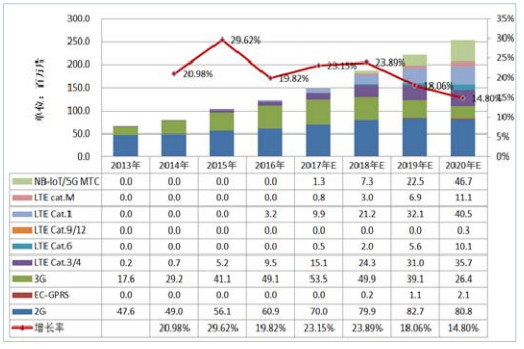

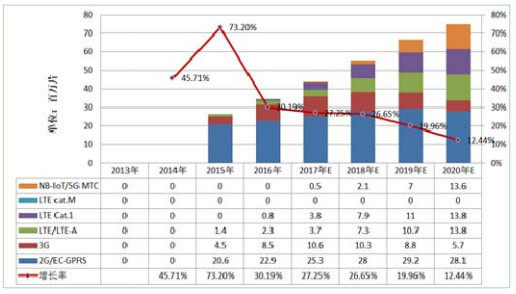

According to the statistics of techno systems research,At the end of 2016, China's cellular communication module Market shipped 34.5 million pieces.LTE based technology has gradually become the mainstream of cellular communication. The scale and forecast of China's cellular communication module market from 2013 to 2020 are shown in the figure.

Copyright © Shenzhen Kinghelm Electronics Co., Ltd. all rights reservedYue ICP Bei No. 17113853