-

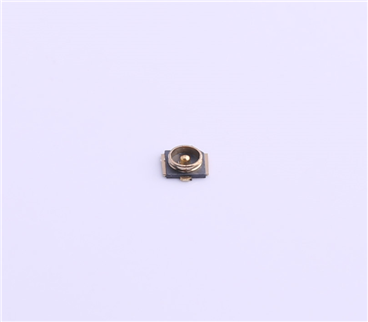

- RF Series

- Connector&plug-in unit

- Plug-in unit

- SD card holder

- SIM card holder

- Thimble /wire protector

- Crimping terminal

- Waterproof joint

- 短路帽/跳线帽

- 压线端子胶壳

- 屏蔽夹

- Waterproof and dustproof terminal

- Industrial&automotive&military

发布时间:2021-12-31作者来源:金航标浏览:2425

Supply chain finance has become a hot topic in supply chain research. In the guidance on actively promoting supply chain innovation and application (hereinafter referred to as the guidance) issued by the general office of the State Council, one of the six key tasks is to "actively and steadily develop supply chain finance"; In the notice on carrying out supply chain innovation and application pilot (hereinafter referred to as the notice) formulated by eight departments including the Ministry of Commerce, it is proposed that one of the six key tasks of the pilot cities is to "standardize the development of supply chain finance to serve the real economy", and one of the five key tasks of the pilot enterprises is to "standardize the development of supply chain finance business". The separately proposed goal of supply chain finance is to provide a safe channel for funds to enter the real economy, serve the real economy, provide low-cost, efficient and fast financial services for qualified small, medium-sized and micro enterprises, and effectively prevent supply chain financial risks.

The real economy that needs the support of supply chain finance covers a wide range and is concentrated in agriculture, industry, circulation industry and even the financial industry itself in the guidance and notice. In fact, the author believes that the logistics industry has the most urgent demand for supply chain finance.

In the 40 years of reform and opening up, the industry represented by "made in China" has been better integrated into the global supply chain system, and has gradually obtained the global market competitive advantage in the medium and low-end manufacturing industry with organizational advantages and cost advantages. However, it has also been valued and prevented by manufacturing powers such as the United States, Europe, Japan and South Korea.

For the circulation industry, although the competitiveness of traditional business channels is not strong, the Internet e-commerce platform has strong global competitiveness and is favored by global capital.

The logistics industry, which connects production and consumption and supports business activities, is seriously lack of capital support. The supply chain of logistics industry needs the support of supply chain finance.

First, the concentration of logistics industry is very low. In the express industry, which accounts for 75% of the transportation market, the industry concentration of the top 10 is only 2.9%, while the industry concentration of road freight is only 1.2%. The vast majority of logistics enterprises belong to small and micro enterprises. They have the characteristics of less fixed assets, limited collateral (pledge), high operation risk, low credit and difficult credit investigation, which are more difficult to obtain financing from financial institutions.

Secondly, most small, medium-sized and micro logistics enterprises generally have the problem of tight capital chain. In particular, the upstream deposit is serious, the account period is getting longer and longer, and the downstream generally needs immediate payment or even early payment, which further aggravates the tension of the capital chain and seriously restricts the growth and strength of small, medium-sized and micro logistics enterprises.

The lack of financial support makes it difficult to improve the industry concentration, which directly leads to the "small scattered difference" of the logistics industry, the confusion of the price system and the difficult prohibition of over limit and overload, and further leads to the weak overall trend of the logistics supply chain, which affects the healthy development of the logistics supply chain and the manufacturing supply chain.

Therefore, the effectiveness of supply chain finance in logistics industry will determine the effectiveness of supply chain innovation and application throughout the country. Martin middot, Professor of Oxford University; Christopher asserted that "the competition in the 21st century is the competition between supply chains."

At the same time, when the overall economy presents a new normal and the manufacturing industry is curbed, stimulating consumption with commerce and trade has become a phased key task of national economic development. As the guarantee of manufacturing and trade circulation, the logistics industry has naturally evolved into the current national strategy. However, small, medium-sized and micro logistics enterprises that most need working capital in the logistics industry are the most difficult to obtain working capital financing. The phenomenon of difficult and expensive financing is far more serious than manufacturing enterprises and circulation enterprises.

Although the state has issued policies for many years to support financial support for small, medium and micro private enterprises, and even established special financial institutions and credit systems for small, medium and micro private enterprises. However, under the reality that the market for small, medium-sized and micro private logistics enterprises is highly uncertain and the credit is seriously insufficient, the policy dividend of forcing financial institutions to reduce financing costs and improve financing risks can not run for a long time in a truly perfect market, and the specific executors of financial institutions will also be greatly discounted when landing; In addition, it distorts the normal operation of the survival of the fittest mechanism in the market, which is unfavorable to the healthy and sustainable growth of small, medium-sized and micro private logistics enterprises that meet the market demand and have high credit and core competitiveness.

Therefore, the capital side, asset side and service side enterprises involved in supply chain finance, such as commercial banks, trusts, funds, insurance and supply chain core enterprises, are struggling in the upstream and downstream game of the whole supply chain risk control. Due to the separation of responsibilities and rights, it often leads to repeated pledge, empty single pledge and excessive damage of pledged goods. The suppliers involved in supply chain finance often terminate halfway because of the high loss cost of insufficient risk control and the high prevention cost of excessive risk control, which makes supply chain finance only stay in concept.

Supply chain finance is different from the previous logistics finance. The existing traditional logistics finance modes, such as warehouse receipt pledge financing, contract pledge financing and credit financing, effectively make use of the chattel pledge right of small and medium-sized logistics enterprises to carry out proportional financing or leverage financing, but often cause excessive damage to the pledged goods due to the inconsistency of responsibilities and rights; Focusing on the supply chain finance model of core enterprises covering upstream and downstream small and medium-sized enterprises, there are also some problems, such as limited and difficult transfer scenarios of commercial bills / bank bills, and it is difficult for core enterprises to self credit, which makes the financial risk control too strict and the cost of risk control too high to achieve the real economy of supply chain financial services The comprehensive goal of promoting the financing of small, medium-sized and micro enterprises at high efficiency and low price and controlling financial risks.

How can commercial banks, factoring enterprises and other capital side enterprises confirm the core enterprise's own credit with low cost and high efficiency? How can the core enterprises in supply chain finance of "1nx" mode accurately confirm the authenticity of chattel pledge and credit pledge covering upstream and downstream small and micro enterprises? How to form an industrial closed supply chain environment led by supply chain finance? Big data and Internet of things have become the most powerful technical support for supply chain finance.

Third party big data and cloud services that are protected and can be shared can form a credit platform that penetrates the real information of the whole supply chain; The Internet of things, which supports the interconnection of all things in the closed-loop supply chain, can accurately control the real-time monitoring and automatic matching of resources in the whole chain; The fund closed loop based on artificial intelligence can realize the functions of machine credit and intelligent risk control at low cost and high efficiency.

Internet e-commerce leading enterprises, whether B2B or B2C, can rely on the real transaction flow of the platform to form an enterprise and personal credit evaluation system centered on e-commerce, which has achieved the supply chain financial innovation of leading e-commerce logistics enterprises, but it has little impact on more, broader, small, medium and micro logistics enterprises.

Therefore, different from the capital end, asset end and service end of e-commerce platform, all kinds of entrepreneurs with their own credit verification need to rely more on the big data model that does not directly involve the benefits of investment enterprises to strengthen the credit investigation and risk control ability of all links of the supply chain.

In 2019, with the commercialization of 5g, China will realize faster speed, more equipment and more real-time communication connection, and better support stronger data accumulation, data service and data application experience capabilities; In particular, edge computing MEC, which is perfect with 5g technology, can also drive the development of high data quality, high security and high interaction.Using big data and cloud service technology to empower supply chain finance and integrate the third-party support data and business service functions of the supply chain will better enable logistics supply chain finance to serve supply chain innovation and application.

Copyright © Shenzhen Kinghelm Electronics Co., Ltd. all rights reservedYue ICP Bei No. 17113853