-

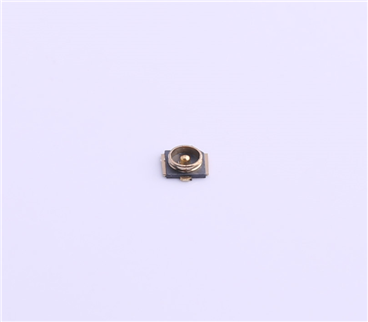

- RF Series

- Connector&plug-in unit

- Plug-in unit

- SD card holder

- SIM card holder

- Thimble /wire protector

- Crimping terminal

- Waterproof joint

- 短路帽/跳线帽

- 压线端子胶壳

- 屏蔽夹

- Waterproof and dustproof terminal

- Industrial&automotive&military

发布时间:2021-12-31作者来源:金航标浏览:2328

The phenomenon of "difficult and expensive financing" of private small, medium and micro logistics enterprises has a long history. This phenomenon can even be traced back to the early stage of reform and opening up, which seriously restricts the growth and strength of small, medium and micro logistics enterprises. In addition, small, medium-sized and micro enterprises have a low voice in the logistics supply chain, long accounting period and tight capital chain, which makes the industry concentration seriously low. The data show that the industry concentration of road freight transportation is only 1.2% and that of express transportation is only 2.9%, which seriously affects the efficiency of cost reduction and efficiency increase in the logistics industry.

The state has also repeatedly issued policies, including supporting large state-owned commercial banks to independently formulate inclusive credit plans for small and micro enterprises, implementing low deposit reserves for small and medium-sized banks to release incremental funds for loans to small and micro enterprises, promoting financing bond support tools, supporting various intermediary service institutions, and guiding private capital to finance loans to small and micro enterprises. Each strong implementation of the policy has slightly alleviated the problem of "difficult and expensive financing" for small, medium-sized and micro enterprises, but it soon changed into "capital idling" within financial institutions in specific operation, restoring the original normal of "difficult and expensive financing".

The reason why relevant policy dividends are quickly exhausted by the market operation mechanism owned by the capital is that small, medium-sized and micro private enterprises generally have weaknesses such as "less collateral", "low credit level", "opaque information", "non-standard finance", "high non-performing loan rate", "weak sustainable operation ability" and "poor anti risk ability", which objectively causes the financial institutions themselves to respond to high risks Poor credit, weak information and lack of guarantee contradict the subjectivity of financing of small, medium and micro enterprises, so "the loan threshold is high, the loan interest rate is high, the renewal cost is high, the credit procedures are complicated, the credit procedures are slow, and the credit time matching is poor". Especially for state-owned financial institutions, the specific executive level has great concerns about the political risk of financing private enterprises (even large and medium-sized private enterprises), and gives priority to "Inaction" or "less action" for "personal safety".

The rise of supply chain finance has opened up a new way for the financing of small, medium-sized and micro logistics enterprises. Focusing on the supply chain financial model of core enterprises covering the whole upstream and downstream enterprises, the credit investigation system of small, medium-sized and micro enterprises in the status of non core enterprises in the supply chain is transformed into the credit investigation system of core enterprises in the supply chain, which partially realizes the dynamic financing problem of small, medium-sized and micro enterprises in operation, and has a certain attraction to banks, factoring and other financial institutions.

However, after several years of operation, due to the fact that upstream and downstream enterprises inevitably choose to light assets and multi inventory under the supply chain financial model, the core enterprises in the supply chain financial chain tend to be highly leveraged and highly indebted, which makes it difficult for the core enterprises to self credit, limited and difficult transfer of commercial bills and bank bills, repeated pledge of pledged goods and loss of goods, Banks, factoring and other financial institutions still have doubts about risk control.

At present, governments and financial institutions tend to use new technologies such as big data, cloud services and the Internet of things to improve the credit of small, medium-sized and micro enterprises and the supply chain financial system. In particular, big data and the Internet of things integrate the pledge from the virtual and real two-dimensional space, so as to realize low-cost, efficient and accurate confirmation. The author believes that this is indeed an effective option, but it is by no means a priority.

Credit upgrading is a long process that requires the matching and upgrading of resources in all aspects of the economic environment. The cultivation, development and perfection of individual and enterprise credit in European and American countries have experienced nearly a century, and the use of credit still needs a high credit threshold and credit cost; Due to historical reasons, domestic individuals and enterprises generally have bad phenomena such as low credit starting point, poor credit foundation and high credit investigation cost. The annual "3 & middot; 15" Consumer Day is a concentrated consideration of the integrity of domestic enterprises.

Of course, for the leading enterprises in some industries, building a supply chain financial system can achieve low-cost and efficient credit investigation and use a reasonable proportion of financial leverage. Alibaba, jd.com, pinduoduo and other leading enterprises of Internet e-commerce platforms have built a high supply chain credit system by virtue of real big data on the transaction flow of the platform and strong voice control over small, medium-sized and micro enterprises upstream and downstream of the supply chain, and realized supply chain financial innovation driven by the interests of large-scale, high profit, weak cash and high leverage of supply chain finance, It has solved the problem of "difficult and expensive financing" of some small, medium and micro enterprises in the industry.

However, for the vast majority of small, medium-sized and micro private logistics enterprises, the supply chain financial system with the head enterprise of the Internet e-commerce platform as the core enterprise does not have universality and is difficult to copy or use for reference as a whole.

However, the successful competition between the three party mobile payment platforms such as Alipay and fortune paid (WeChat) in the global payment market has provided an excellent reference for the supply chain finance which is more universal.

In the China's third party mobile payment market, which amounted to 190 trillion and 500 billion yuan in 2018, Alipay and fortune paid (WeChat) accounted for 54.3% and 39.2% respectively, Alipay dominated. Compared with the number or frequency of transactions, Cai Fu Tong and Alipay reached 460 billion and 197 billion 500 million strokes respectively.

The emergence of China's third-party mobile payment platform in the global third-party payment market lies in its efficiency rather than credit. Third party payment platforms such as MasterCard, visa and American Express, as well as third-party mobile payment platforms such as PayPal and applepay, mainly rely on users' credit, but credit has a high threshold and needs a high cost. China act in a diametrically opposite way, such as Alipay and fortune paid third mobile payment platforms. It has directly abandoned the high cost credit certification to users, and has adopted a low credit and efficient way to attract users.

Compared to Alipay and WeChat, WeChat's social transactions started by grabbing red packets and so on, are far superior to rivals in terms of trading frequency, and continue to integrate into the third party mobile payment market with social advantages. Low credit or even no credit does not affect the use of WeChat's payment. The competitive advantage of CAI Fu Tong is rooted in the transaction speed of the third party platform and its derived transaction efficiency, and no credit threshold and zero credit cost also help the small business hawker who has no credit ability to achieve efficient transaction payment, while Alipay with a little higher security but less efficient has a lower transaction frequency. However, the transaction volume is relatively large due to slightly higher security (credit).

Cai Fu Tong and Alipay not only changed the global market structure of the third party payment platform, but also fundamentally changed many of the credit structures that had not been standardized in the market trading system with their large and independent third party financial big data platform. For example, the cash transactions (which are not tax related "black") transactions are difficult to obtain from the financial statements, such as convenience stores, street food and highway express, small and micro businesses, because both buyers and sellers are willing to give priority to WeChat payment or Alipay payment. Finally, it was transformed into obtaining the transaction big data of the third-party mobile payment platform at near zero cost to further enhance the trust of investors, showing the explosive growth of the chain system of community convenience stores and street restaurants.

There are three points that can be learned from the third-party mobile payment platform: first, when the credit of the target enterprise is too low and the credit investigation cost is too high, the high risk of risk control can be compensated through the high efficiency and short cycle of transaction; Second, use the big data support of an independent third-party public platform far away from both sides of the transaction to enhance credit; Third, when both parties have certain social functions, they can effectively reduce the prevention cost.

Therefore, in the near and medium term when it is difficult to fundamentally improve the credit of enterprises and individuals, the innovative supply chain financial system should build a third-party trading platform with efficiency as the premise and primary endowment, and an independent third-party public (information and Finance) platform away from the core enterprises and upstream and downstream enterprises in the supply chain financial system, Build big data and cloud computing services based on third-party public platforms, and build a whole industry chain ecology oriented supply chain system, such as mutual recognition and mutual integration of data, information and funds.

Copyright © Shenzhen Kinghelm Electronics Co., Ltd. all rights reservedYue ICP Bei No. 17113853